90% LTV Bitcoin Loans: Access Cash at 1% APR Without Selling Your BTC

Access up to 90% of your Bitcoin's value without selling. Mezo's high LTV loans let you access cash while keeping your BTC. Learn how Mezo maximizes your capital efficiency and how to manage loan risk to enjoy unparalleled financial freedom.

For Bitcoin holders, the dilemma is a familiar one: your portfolio is strong, but your daily liquidity is tied up. Selling your BTC to access cash means missing out on future gains and potentially triggering a taxable event. But what if you could tap into the value of your Bitcoin without letting it go?

High LTV (Loan-to-Value) Bitcoin loans are the answer, and Mezo is pioneering a new standard of flexibility in this space with its up to 90% LTV offering.

What is LTV and Why Does it matter?

A Loan-to-Value (LTV) ratio represents the size of your loan relative to the value of your collateral. A higher LTV means you can borrow more against your assets. With a maximum 90% LTV Bitcoin loan from Mezo, you can borrow up to 90% of the value of your Bitcoin holdings. This high ratio is a significant advantage for those who want to maximize their capital efficiency. Whether you need to cover a major expense, seize a new investment opportunity, or simply want more accessible cash, a high LTV loan lets you do so without selling your Bitcoin.

How Mezo's 90% LTV Bitcoin Loan Works

At the heart of Mezo's borrowing system is MUSD, a USD-pegged stablecoin fully backed by Bitcoin. When you take out a loan on Mezo, you are not selling your Bitcoin. Instead, you are using it as collateral to mint MUSD. This process occurs through a Collateralized Debt Position (CDP), a transparent and automated system managed by smart contracts.

Here's a simple breakdown of the process:

- Deposit Your Bitcoin: You deposit your Bitcoin into a secure, non-custodial smart contract. Mezo is built on the tBTC bridge, which means your BTC is converted to a decentralized, 1:1 backed ERC-20 token called tBTC. This allows your Bitcoin to interact with smart contracts while remaining verifiably backed by on-chain reserves.

- Mint MUSD: Against your deposited Bitcoin, you can mint MUSD, effectively taking out a loan.

- Access Your Liquidity: The minted MUSD is now yours to use. You can swap it for other cryptocurrencies, use it in DeFi applications, or convert it to fiat for your everyday needs. All the while, your original Bitcoin collateral remains yours.

- Repay and Reclaim: To get your Bitcoin back, you simply repay the MUSD you borrowed, plus any accrued interest. Once the debt is settled, your Bitcoin collateral is fully returned to you.

Read our report here for a deeper dive into MUSD's mechanics and how it maintains its peg.

Understanding Loan Maintenance and Liquidation Risk

Taking on a high LTV loan requires active management, as your loan's health is directly tied to the price of Bitcoin. Here’s what you need to know about maintaining your loan and the risks involved.

- Your Individual Collateral Ratio (ICR): The most important metric for you to monitor is your Individual Collateral Ratio (ICR). This is the ratio of the value of your locked Bitcoin collateral to the amount of MUSD you have borrowed. Mezo requires a minimum ICR of 110%. This means for every 100 MUSD you borrow, you must have at least $110 worth of Bitcoin as collateral. A 110% ICR corresponds to a maximum LTV of approximately 90%.

- The Risk of Liquidation: Bitcoin's price is volatile. If the price of BTC drops, the value of your collateral decreases, which in turn lowers your ICR. If your ICR falls below the 110% minimum, your position is considered under-collateralized and becomes eligible for liquidation. Liquidation is an automated process where the system seizes your BTC collateral and sells it to pay back your MUSD debt. This ensures the system remains solvent, but it means you will lose your Bitcoin collateral.

- How to Avoid Liquidation: The key to managing your loan is to keep your ICR safely above the 110% threshold. Prudent borrowers often maintain a much higher ratio (e.g., 150% or more) to create a larger buffer against price swings. If you see the price of Bitcoin falling and your ICR approaching the 110% minimum, you have two primary options:

- Repay a Portion of Your Loan: You can buy MUSD on the open market and use it to pay down your outstanding debt. This reduces your debt amount, which instantly increases your ICR.

- Add More Collateral: You can deposit more BTC into your CDP. Increasing your collateral while keeping your debt the same will also raise your ICR.

By proactively managing your ICR, you can enjoy the benefits of high LTV borrowing while minimizing the risk of liquidation.

Keep Tabs on your Loan with MUSD Monitor

For advanced monitoring, you can use mezotools.cc.

This tool allows you to:

- Check real-time Trove health and Collateral Ratios.

- View recent system-wide redemptions and liquidations.

- Track BTC and MUSD prices directly from Mezo’s on-chain oracles.

Why Mezo's 90% LTV Loan is the Best Option for Bitcoiners

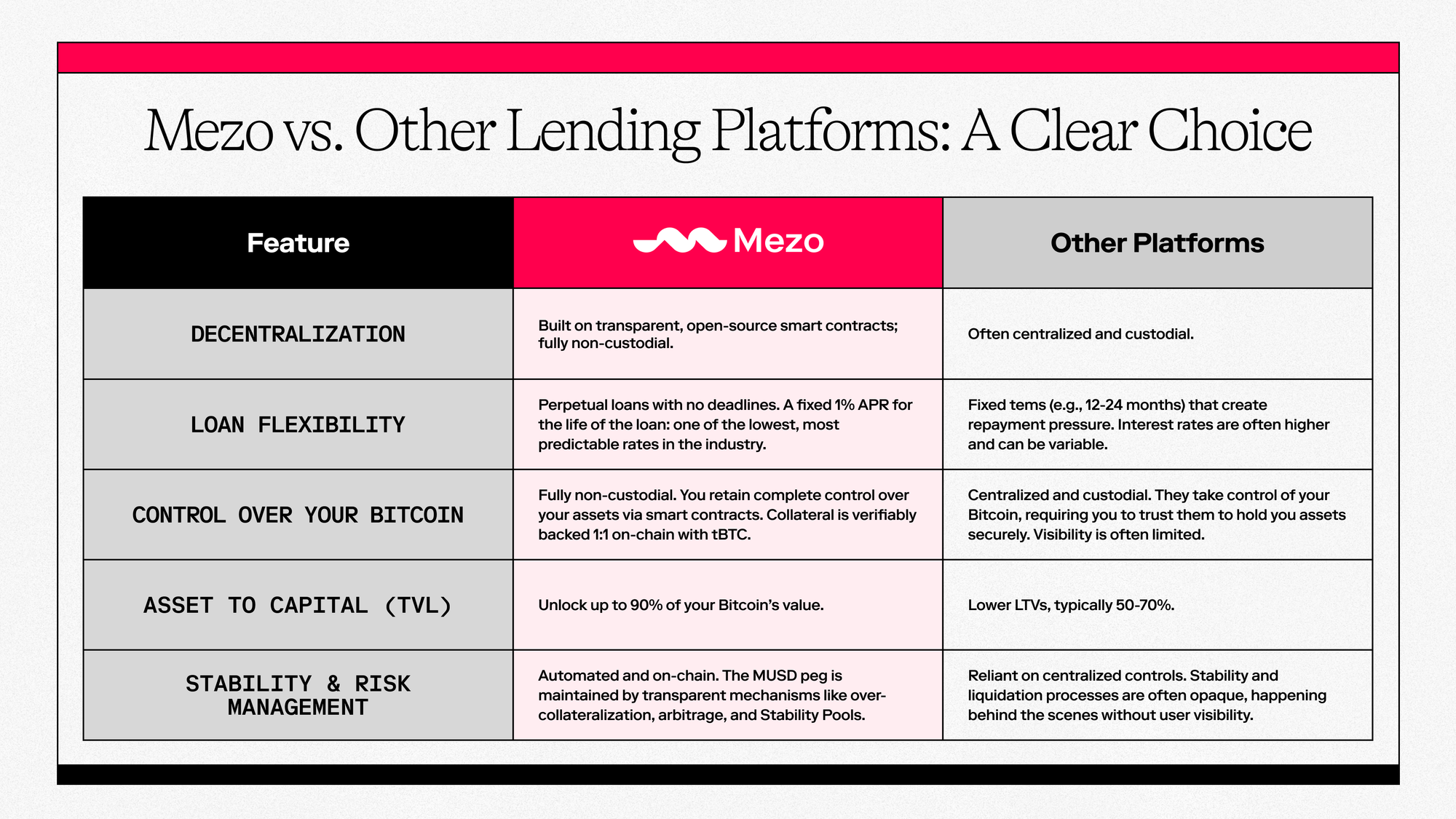

While several platforms offer Bitcoin-backed loans, Mezo's approach stands out for its commitment to decentralization, security, and capital efficiency. Here's how it compares:

Get Started with Mezo

Mezo is empowering Bitcoin holders to do more with their assets. By providing a high LTV, decentralized, and secure borrowing platform, Mezo is setting a new standard for what's possible in the world of Bitcoin-backed finance.

Experience unparalleled financial freedom without selling your Bitcoin. Get started with Mezo's revolutionary 90% LTV loans on the Mezo Borrow Platform.

Learn more about Mezo’s pioneering stablecoin, MUSD, here.

Let's build the circular Bitcoin economy. Follow @MezoNetwork

🏦 Start borrowing • 📚 Read the docs • 💬 Join Discord • 🛡 View audits

Disclaimer: References to expected yields, APY, or other performance metrics are based on current performance and protocol parameters. Actual returns may be subject to change due to market conditions, protocol governance decisions, and other risk factors. Users are responsible for carrying out their own due diligence before choosing a Vault, and for monitoring any changes made to the Vault over time, particularly those subject to a time lock.