Be the Bank You Wish Existed

Still selling Bitcoin to access cash? That’s the most expensive mistake a Bitcoiner can make. Mezo lets you borrow against BTC at 1% APR—no banks, no selling, no permission. Bitcoin-native finance is live. Be your own bank.

You already own Bitcoin, but the moment you need liquidity, you still rely on a bank.

That's the unfinished business of financial sovereignty. You took custody of your BTC, moved it off exchanges, and maybe even run your own node. However, when you need $10,000 for a down payment, an emergency, or an opportunity, you're back to the same choice: sell or borrow from someone else's system.

And in 2025, that reliance comes with growing risk. Many believed Operation Chokepoint 2.0 had concluded, but recent stories show otherwise. Banks, payment processors, and custodians are still quietly off-ramping those who don’t fit the model. Sometimes the target is a company. Sometimes, it's just a person with the wrong profile.

Financial sovereignty is secured by living on Bitcoin. That means eliminating the final dependency: banking with centralized entities.

Functional Autonomy

Before the Federal Reserve. Before central banking. Before "too big to fail."

There was free banking.

Historically, the phrase "free banking" referred to an era in which banks issued their own money, backed by assets they held in reserve. In 19th-century Scotland, a bank’s strength came from sound collateral and transparency, not from regulatory privilege or a central lender of last resort.

Bitcoin reintroduced sound collateral. But it didn’t rebuild the banking function itself. You can hold Bitcoin, but the moment you need liquidity, you’re routed through the same chokepoints that Bitcoin was designed to avoid.

A Bitcoin that must be sold to be useful isn't self-sovereign. A Bitcoin that earns, borrows, and circulates inside its own economy is.

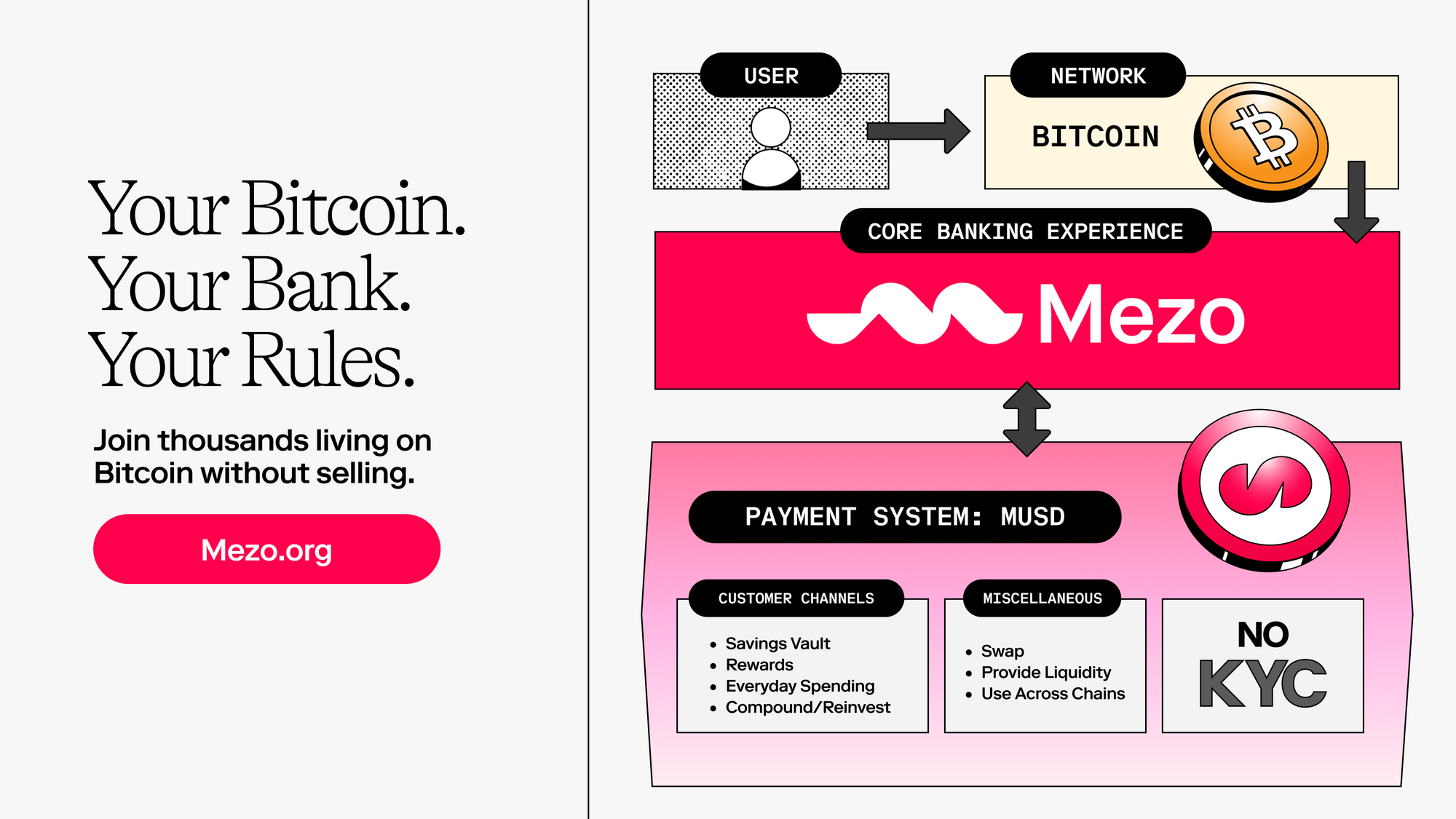

Mezo enables a complete financial stack native to Bitcoin. The system creates functional autonomy through three core functions:

- Save: Your BTC stays locked and appreciating while generating borrowing power

- Spend: Access MUSD liquidity at 1% APR for real-world needs without selling your Bitcoin

- Earn: Deploy MUSD to generate yield, compound returns, and build wealth.

Simulating Being your own Bank

Every Bitcoiner will eventually face the same decision: you need $10,000, but don’t want to lose your BTC exposure. Here are your options:

Consider the real example from 2020 to 2024. Bitcoin reached a value of $10,000 in October 2020. By December 2024, it hit $102,900.

- If you sold: You got $10,000 cash, missed $92,900 in appreciation.

- If you borrowed at 10% APR: Four years of interest = ~$4,000. Total owed: $14,000. Your BTC worth: $102,900. Net position: $88,900.

- If you borrowed at Mezo's 1% APR: Four years of interest = $400. Net position: $102,500.

One Mezo user borrowed $1,800 against $8,500 in BTC for groceries. As BTC appreciated during the loan period, they ended up with a higher net position after repayment.

Traditional banks typically do not lend against Bitcoin. They don't understand it, can't custody it, won't recognize it.CeFi lenders (Nexo, Ledn) are traditional banks with a Bitcoin veneer. They take your deposits, make loans, and keep the spread. You're still the customer, not the bank. Plus 10-18% APR makes them loan sharks, not banks.

Ethereum DeFi (Maker, Aave) gets closer, but requires wrapping your Bitcoin, bridging chains, and accepting smart contract risk. You're operating someone else's bank on someone else's chain. And still paying 5-8% APR.

Mezo is different:

- Bitcoin-native (no wrapping)

- Self-custodied (your keys, your coins)

- 1% fixed APR (infrastructure pricing, not rent-seeking)

- 90% LTV available (actual capital efficiency)

- You're the bank (not the customer)

What Banking on Yourself Actually Looks Like

When you bank on yourself, here's your daily reality:

Morning: Check your vault health. Bitcoin rose, and your collateral ratio improved overnight. Your borrowing power has increased without any action on your part.

Noon: Need $5,000 for an unexpected expense? Mint 5,000 MUSD against your BTC collateral. No application. No waiting. No permission. 1% APR fixed.

Evening: Deploy unused MUSD to earn yield. Earn 8% APR in a stablecoin pool. You're borrowing at 1%, earning at 8%. That's a 7% profit margin. That's what banks do.

Next Month: Bitcoin rises again. Your collateral value increased. You can mint more MUSD or enjoy the improved security margin.

Next Year: Repay the MUSD with income, with trading profits, or by selling a tiny fraction of your appreciated BTC. Your choice. Your timing. You = the bank.

Mezo Let’s You Be Your Own Bank

Every day you hold Bitcoin but rely on traditional banking, you're living a contradiction.

This ends now.

You have 48 hours to make Banksgiving 📸. But you have the right now to make a bigger decision: remain their customer or become your own bank.

Being your own bank means maximizing control and minimizing cost. A decentralized, Bitcoin-backed loan at a fixed 1% is about as close to ideal as it gets.

They debanked us. So we became the bank.

The best time to become your own bank was in 1837. The second-best time is now.

Welcome to Free Banking. Welcome to Mezo.