Earn, Save, Spend on Mezo

Mezo transforms Bitcoin from a store of value into a full banking experience. Earn real BTC yield, mint MUSD to spend, and save without giving up self-custody. Don't sell your stack to access liquidity. Bank on yourself with Mezo.

Bitcoin works as a store of value. Mezo is built for what comes next.

Mezo is a self-custodial BTC banking experience built to let you save, spend, and earn—without giving up self-custody or selling your BTC.

Users lock bitcoin, mint a dollar-denominated stablecoin (MUSD) against it, and use their bitcoin-backed dollars as they see fit. In Mezo, BTC activity happens around it rather than through its sale or rehypothecation.

Here’s a guide to maximizing your BTC-banking experience.

Earn

Earning on Mezo is built around a simple constraint: Bitcoin yield should be paid in Bitcoin.

Look at the dominant models right now. Babylon lets you stake BTC, but you earn Babylon's token. Starknet's BTC staking pays out in STRK. These platforms use your Bitcoin to secure their networks, then compensate you in a different asset entirely. You're taking BTC risk, locking BTC liquidity, and getting paid in something you probably need to sell.

That's not Bitcoin yield. That's Bitcoin-as-collateral yield. The distinction matters if you're trying to grow a BTC stack rather than accumulate governance tokens you don't want.

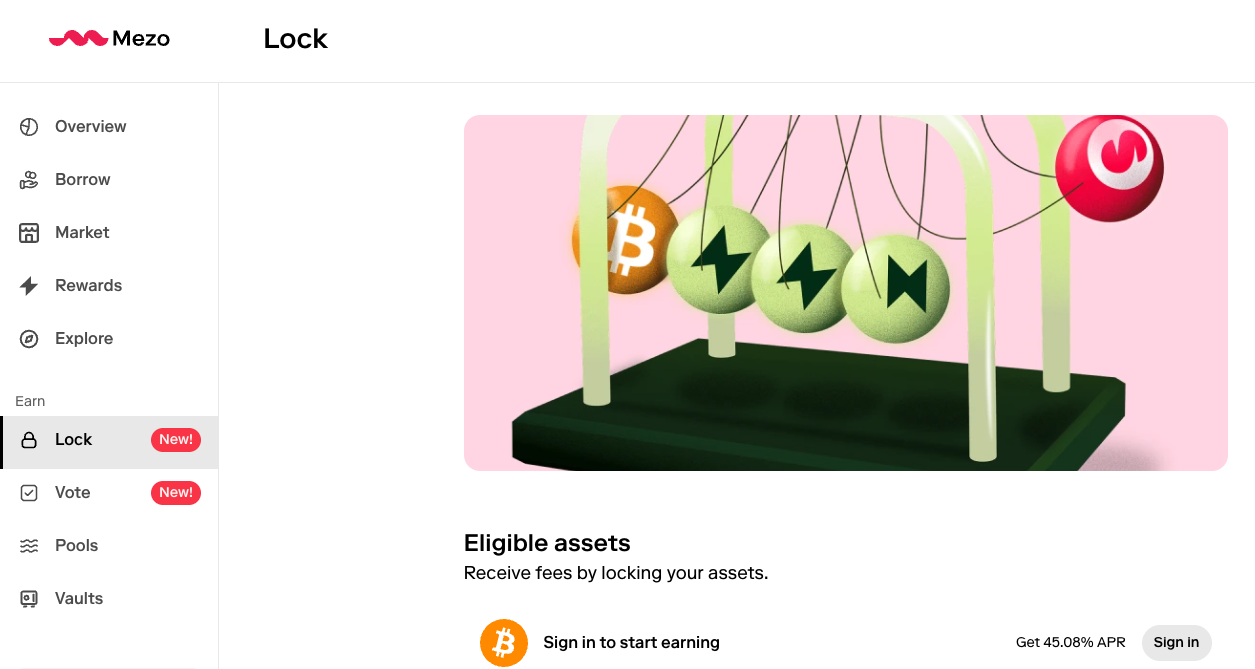

When BTC is locked, it becomes veBTC, a time-weighted position that participates in network revenue. As activity occurs on the chain—bridging assets, executing swaps, originating loans, refinancing debt—fees are generated in Bitcoin. Those BTC-denominated fees are routed directly to BTC holders in proportion to how much BTC is locked and for how long.

This yield does not depend on a single mechanism. It is sourced from multiple, independent revenue streams generated on the Mezo chain:

- Fees from BTC and MUSD swaps

- Fees from borrowing, refinancing, and loan origination

- Fees from chain usage and bridging activity

These sources move differently over time. Trading volume, borrowing demand, and cross-chain activity are not perfectly correlated. As a result, BTC yield on Mezo is not reliant on a single pillar remaining strong. It reflects aggregate usage of the system.

This stands in contrast to designs where BTC yield depends primarily on one activity—such as staking derivatives or a single revenue engine. On Mezo, BTC earns whenever Bitcoin is being used in any meaningful way across the network.

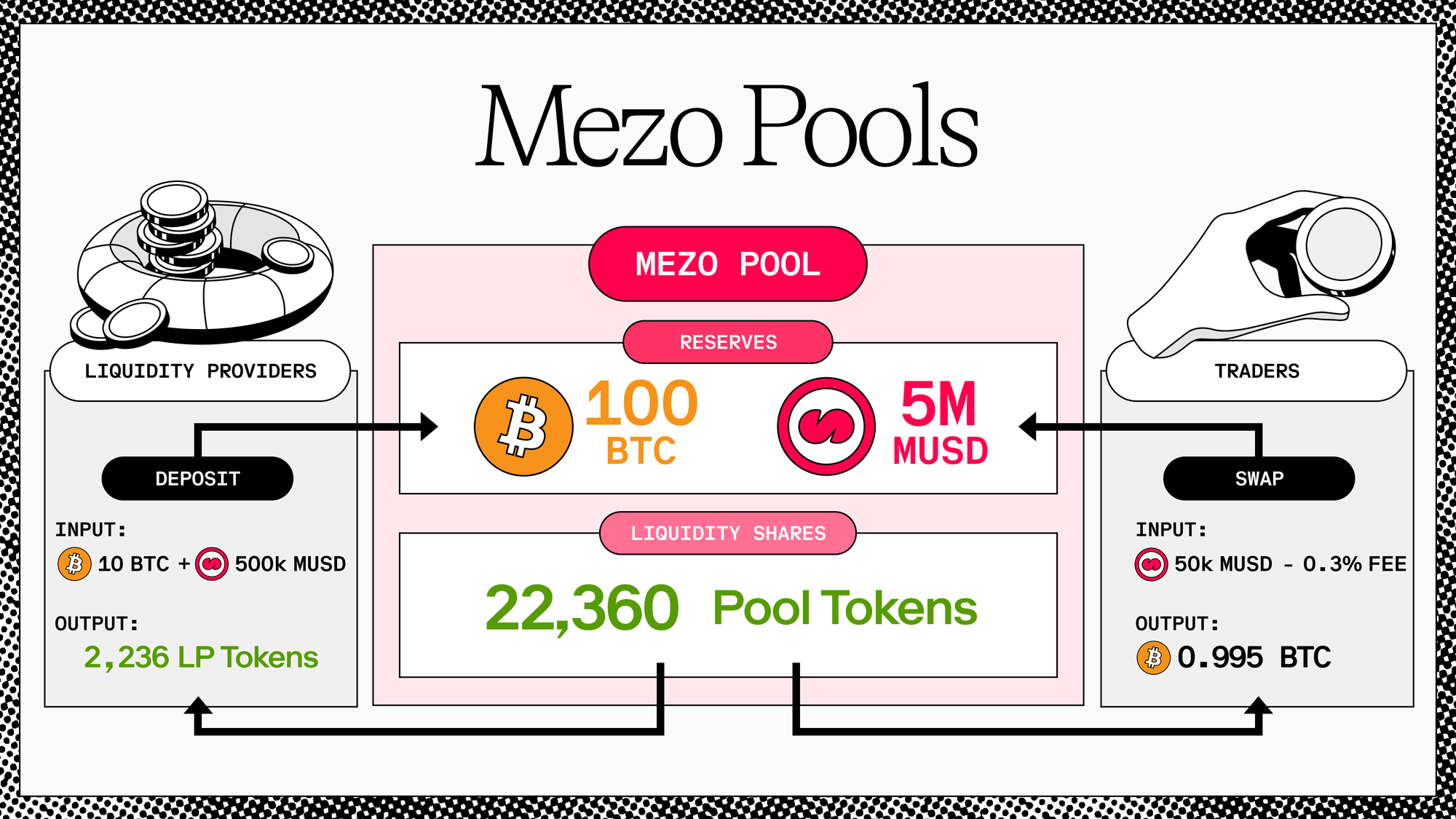

Alongside this base Bitcoin yield, Mezo offers an ecosystem of vaults and pools that allow users to deploy MUSD without selling their BTC. These include conservative lending vaults that earn interest from over-collateralized loans, as well as liquidity vaults and pools that generate fees from trading activity. Vaults handle route selection, rebalancing, and harvesting, allowing users to earn without managing loops, hedges, or incentive claims manually.

Read more about additional earning methods on Mezo here.

Spend

The main friction for Bitcoin holders is being "cash poor." You have capital, but you can’t buy groceries or enter a trade without triggering a tax event and losing exposure to BTC price appreciation. Mezo adds a spend layer via MUSD.

Once BTC is locked, MUSD can be drawn within collateral limits and used for trading, payments, or interaction with other onchain applications. The liability is denominated in dollars, so the amount owed does not fluctuate with BTC price movements, though collateral requirements still apply.

This allows users to access liquidity without selling bitcoin. As such, you can use MUSD to:

- Trade: Enter positions on decentralized exchanges.

- Transact: Pay for services or bridge to other networks.

- Cycle: Repay your loan when you choose to unlock your original BTC.

Bitcoin is kept on your balance sheet so you capture the upside if the price rises, while using the minted dollars for daily needs or new opportunities.

Save

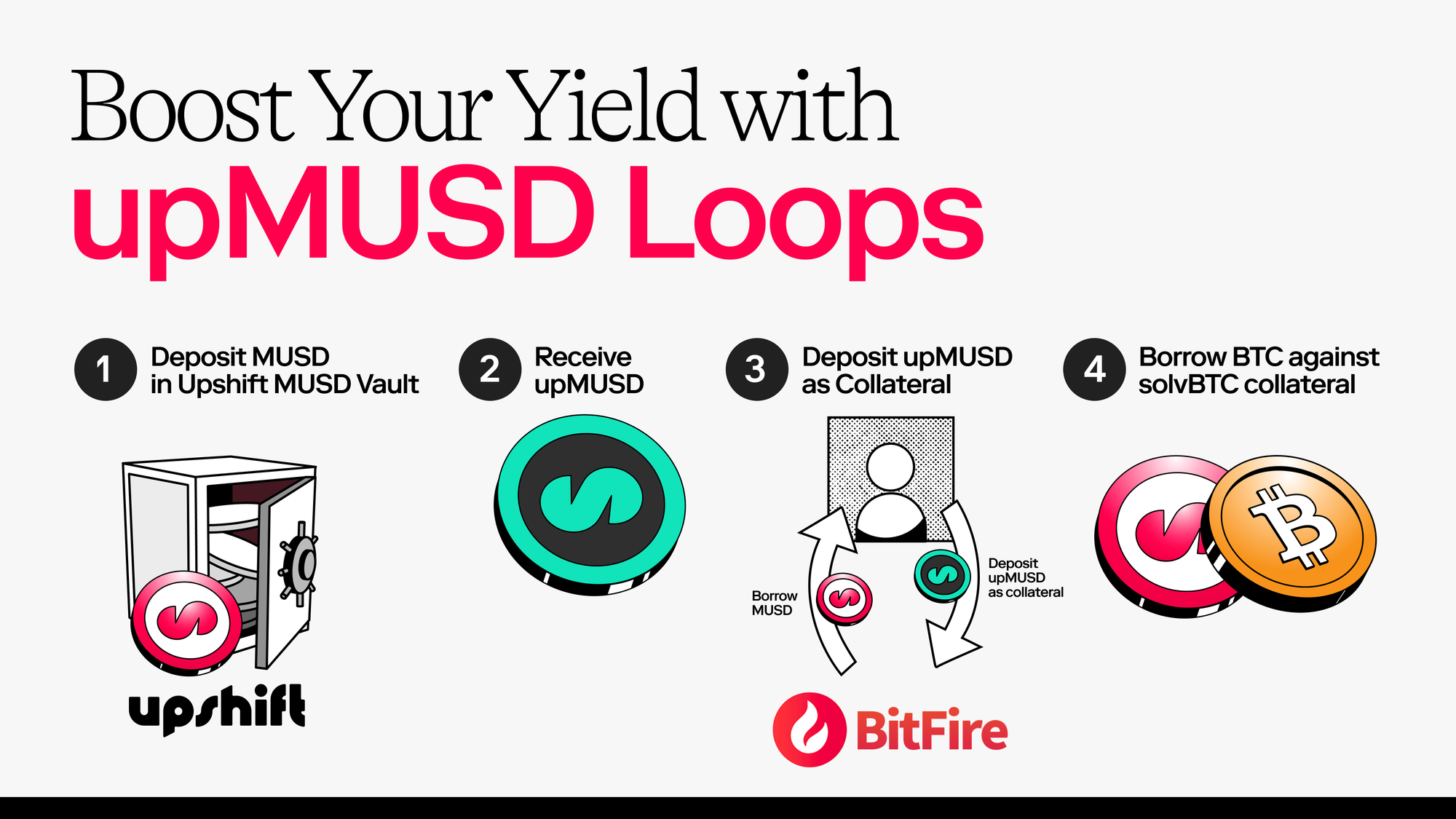

Saving on Mezo starts with MUSD. Once you’ve minted or acquired it, the lowest-friction option is the Mezo MUSD Savings Rate Vault. You deposit MUSD and earn a pro-rata share of protocol fees that come specifically from MUSD borrow activity—interest paid on MUSD debt, plus issuance and refinance fees that accrue each epoch. There’s no withdrawal timelock (0 hours) and no withdrawal fee, so it behaves like an onchain savings account whose rate floats with real borrowing demand.

If you don’t want a vault, MUSD is still useful as plain, portable dollars. You can keep it liquid and deploy it wherever your risk tolerance sits—stay on Mezo, or bridge to Ethereum and use established venues like Curve or Uniswap. The key trade is simple: if you’re a BTC holder, you can borrow MUSD at a fixed 1% APR, then decide how conservative or aggressive you want to be with the dollars while your BTC exposure stays intact.

Start Earning, Spending, & Saving on Mezo

Bitcoin doesn’t need to be replaced or wrapped to be useful. It needs a system built around it.

Mezo lets you keep BTC in self-custody, earn real Bitcoin yield, and access dollars without selling. If you’ve been waiting for a way to put Bitcoin to work without giving it up, Mezo is your moment.

Save, spend, or earn. Pick one or pick all three.

The time is now. Bank on yourself.