How Mezo's veBTC Solves Bitcoin’s Yield Problem

Mezo Earn's economic system enables veBTC holders to earn sustainable Bitcoin yield backed by real protocol fees. veBTC captures revenue from MUSD interest, swaps, and bridging. Explore how Mezo’s veBTC and veMEZO create the most robust, capital-efficient model for earning on Bitcoin.

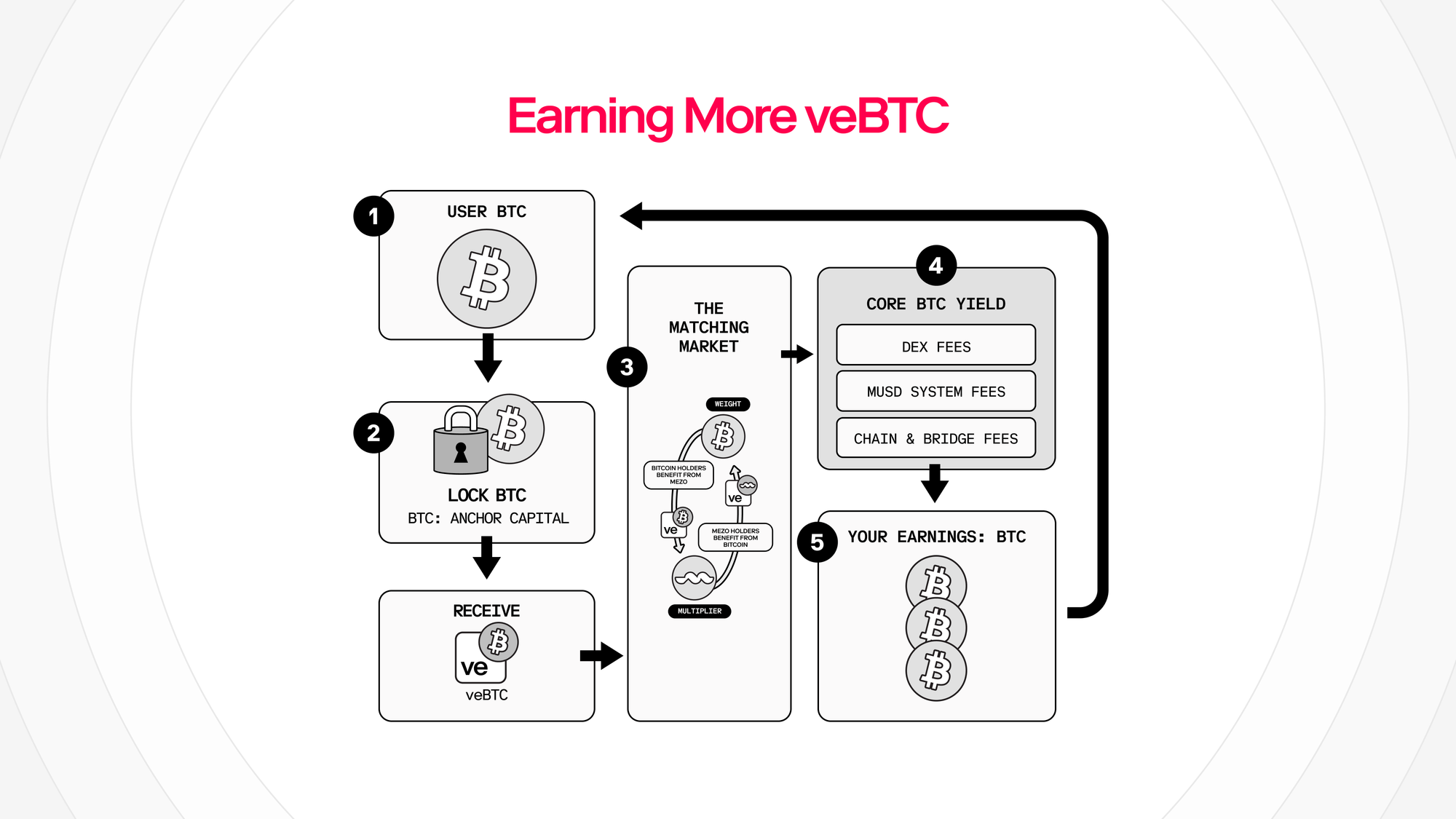

When you lock BTC on Mezo, you receive veBTC and accrue BTC fees from the many revenue streams on Mezo. As such, veBTC on Mezo is the most sustainable, robust, and capital-efficient manner to earn BTC yield in a self-custodial manner.

When a user deposits Bitcoin into Mezo, they select a specific lock duration. The protocol grants veBTC proportional to both the amount of Bitcoin deposited and the length of time it is locked. A longer lock results in a higher weight, giving the user more governance influence and fee claims.

What is veBTC, and why is Mezo’s implementation unique?

The primary function of veBTC is to solve the incentive misalignment found in many decentralized protocols. Fee-backed BTC yield is a consequence of this economic design.

Before Mezo’s veBTC, most BTC yield products derive their payouts from a single (and, as a result, inefficient) source. If that source dries up or compresses, the yield collapses. You see this in three common patterns.

The first is basis-style yield (carry trades, lending out BTC, structured products). Returns depend on a specific market regime and the solvency of counterparties. When leverage unwinds, spreads compress, or credit tightens, the yield is either cut or socialized through liquidation and rehypothecation risk.

The second is incentive yield, which is driven by inflation. A protocol mints a token to subsidize liquidity, then refers to the subsidy as “BTC yield” by swapping emissions into BTC or routing incentives through a wrapper. That can work for bootstrapping, but it is not a durable funding source. As emissions decline, the payout also declines with them, unless real fees replace the subsidy.

The third is fragmented BTC onchain yield from wrappers and bridges. Even if the underlying strategy is sound, the user is forced to pick a specific representation of BTC and accept the trust assumptions of that bridge. Liquidity fractures across wrappers, each with different risks and different venues, which makes it hard for any single system to accumulate deep, stable BTC liquidity.veBTC is designed to maximize capital efficiency.

Three fee streams

veBTC is the claim key for Mezo’s aggregate revenue:

1. MUSD loan interest.

Users borrow MUSD against their BTC collateral at a fixed rate of 1%. That interest accrues to the protocol and gets distributed to veBTC holders via gauges.

2. Swap fees from BTC/MUSD pools.

Every trade through the BTC/MUSD liquidity pools generates a fee. Liquidity providers and veBTC voters capture portions of this.

3. Chain and bridging fees.

Moving BTC into and around the Mezo ecosystem costs fees. These fees flow back to veBTC holders as base revenue.

Instead of asking BTC holders to pick which revenue stream they want exposure to, veBTC is the unit that can earn across the whole set of streams the chain produces.

Fee routing follows a consistent pattern. Fees generated by pools, vaults, or protocol activity are accumulated over an epoch and distributed to veBTC voters who allocated voting weight to the corresponding gauges. Distribution is proportional to each position’s effective voting weight at the time of allocation. Some revenue streams, such as certain chain and bridging fees, accrue passively to veBTC holders without requiring active voting, reflecting the role of locked BTC as system-wide collateral.

How veMEZO scales veBTC yield

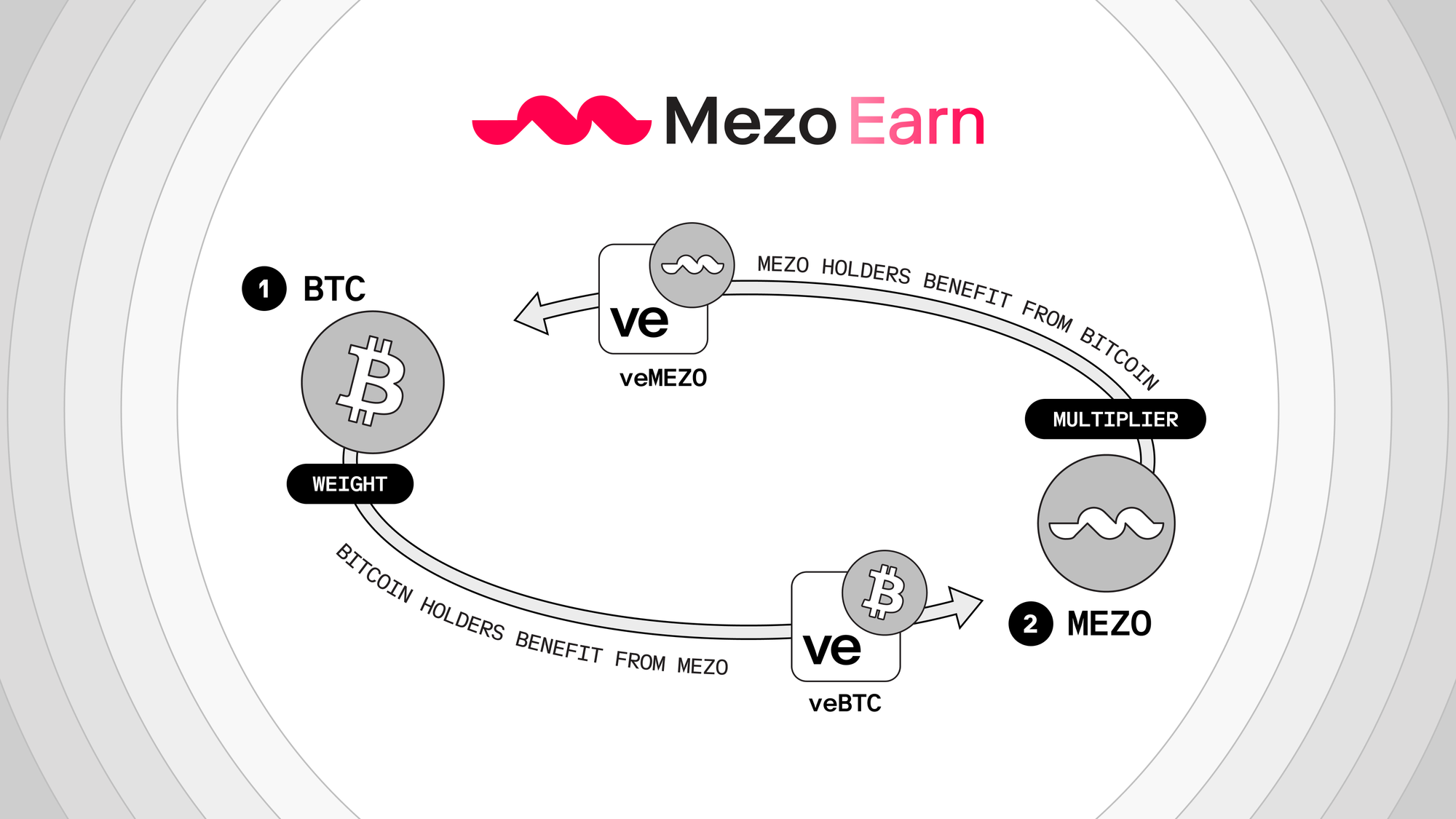

The Mezo Earn economic system runs on a dual-token model. BTC is the anchor. MEZO is the boost.veBTC defines the base level of influence and fee entitlement on Mezo. Boosts exist to allow participants to scale their influence, but only under strict constraints. Your veBTC position gives you a base voting weight (1x multiplier). You can participate in governance and earn fees with nothing but locked Bitcoin. However, if you want more influence, you need veMEZO.

veMEZO is created by locking MEZO for longer durations than BTC locks, with a maximum of four years. This longer horizon reflects MEZO’s role as the chain’s coordination asset rather than its economic anchor. Adding veMEZO can raise that weight, but only up to a fixed maximum. No amount of MEZO can push a position beyond that cap.

Two design choices matter here:

- First, boosts are proportional, not absolute. The amount of boost a veBTC position receives depends on how much veMEZO is attached relative to the total veMEZO in the system, and how large that veBTC position is relative to total veBTC. A small BTC position can be meaningfully boosted with a modest amount of veMEZO. A large BTC position requires proportionally more veMEZO to reach the same multiplier. This prevents large BTC holders from cheaply dominating the system by adding a token dusting of MEZO.

- Second, boosts are attached per position, not globally. Each veBTC position has its own boost slot. veMEZO holders choose which veBTC positions to attach to, and those attachments determine where boosted weight exists in the system. This structure turns boosts into a market.

A BTC-heavy participant who does not want to hold large amounts of MEZO can still access higher boosts by offering incentives on their veBTC position. MEZO holders can then choose to attach their veMEZO to that position in exchange for those incentives. The BTC holder pays to scale their influence; the MEZO holder earns yield by providing boost capacity.

Conversely, a MEZO-heavy participant can seek out veBTC positions that offer attractive incentives or route meaningful fee flows. By attaching veMEZO to those positions, they convert MEZO into exposure to BTC-denominated revenue without needing to hold large amounts of BTC themselves.

Get Started

veBTC is the mechanism that lets Bitcoin participate fully in Mezo’s economy, but understanding it abstractly is only the first step.

Ready to get started? Watch our step-by-step walkthrough to see exactly how locking works. Dig into the full documentation if you want the technical details. Or skip straight to the Mezo app and lock your first position.