Bitcoin Loan Rates: How to Borrow at 1% with Mezo

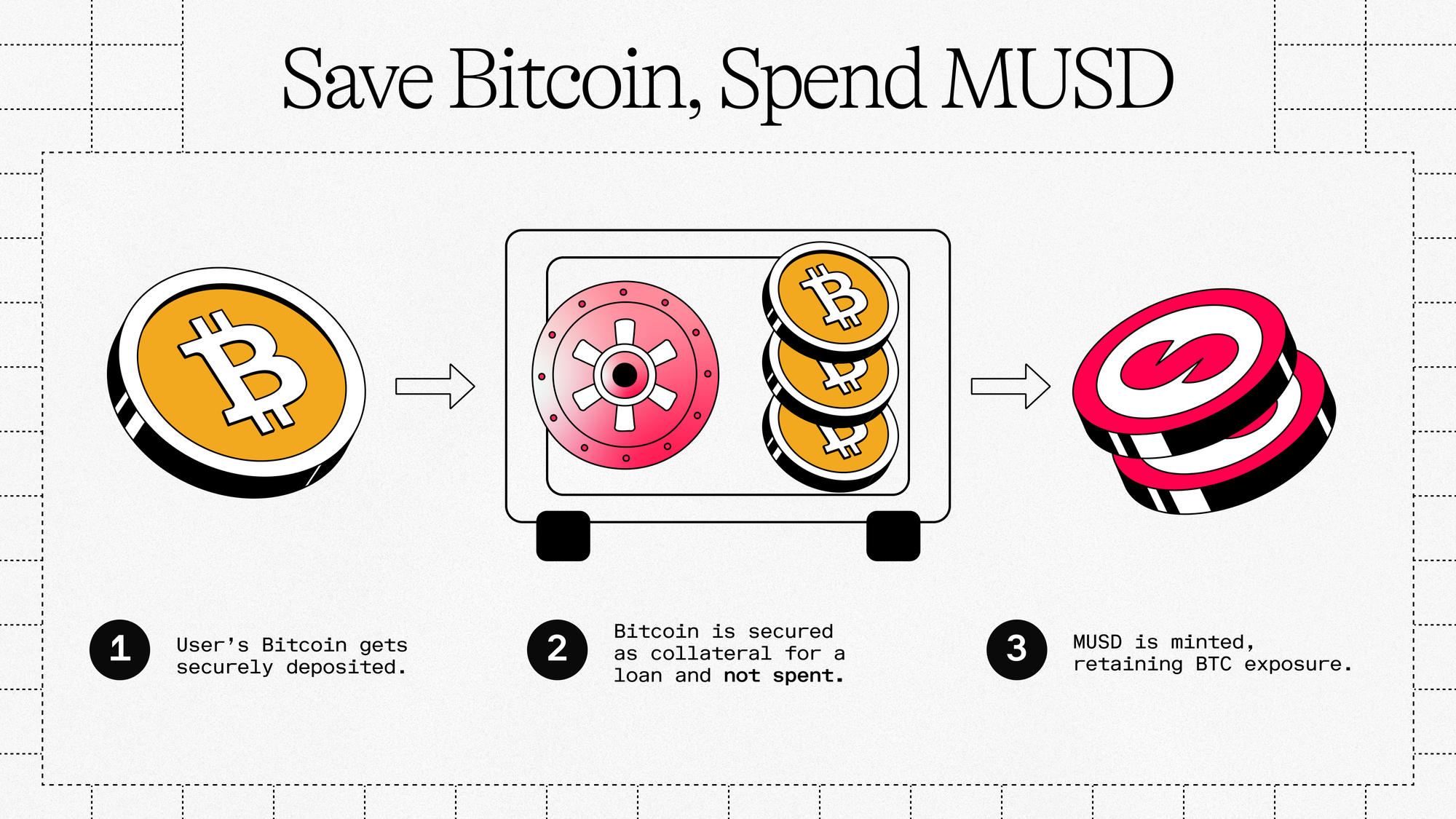

Borrow at just 1% with your Bitcoin on Mezo (limited time offer). No monthly payments, no surprises—keep your BTC and access ultra-low-cost credit anytime.

What if you could get a 1% mortgage rate to purchase your dream house? That would probably change your budget, give you some more flexibility, and help you sleep better at night.

Now that Mezo is live, you can. Forget the 7% (or more!) that banks are charging you.

On Mezo, Bitcoin holders can access an MUSD line of credit at a market-leading 1% fixed interest rate*. Create a Mezo account, deposit your BTC collateral, and take out your first loan in minutes.

Once you've got your 1% interest rate secured, you can adjust your position (take out more debt, top up collateral) without losing your 1% rate – it remains fixed for the life of the loan with no required monthly payments.

Once you're ready to close your loan, you just pay back the MUSD with accrued interest, your Bitcoin goes directly back into your wallet, and you're on your way.

This walkthrough will show you exactly how to do it.

But hurry – the 1% rate is only available for a limited time.

Step 1: Create a Mezo Account to Access Bitcoin Loans

If you already have an account, skip to step 2. Account creation and borrowing currently is only available via desktop.

Head to mezo.org

In the top right corner of the landing page, you will see a “Sign in” button where you can follow the steps to create your Mezo account.

Today, users can create an account with the following options (Hardware wallets, such as Ledger devices, can be used with the following wallet extensions):

- Bitcoin Wallets: Xverse, Unisat, OKX

- EVM Wallets: Taho, Metamask, Rabby, Zerion, OKX

Once your account is created, you can see your asset balances, such as BTC, MUSD, mats, other BTC variants (cbBTC, solvBTC), and any other tokens you hold on Mezo.

Directly from the “Overview” page, you can easily deposit more funds or click “Borrow” to take out your first MUSD loan.

Creating Mezo account

Step 2: Borrow MUSD at 1% Fixed Bitcoin Loan Rate

Note: The 1% interest rate is offered for a limited time, and the interest rate is subject to change via governance. Ensure you have leftover BTC to cover gas fees after creating your position!

Head to the “Borrow” tab to take out a Bitcoin loan on Mezo. Here, you’ll see your eligible borrow and collateral amounts, along with answers to FAQs.

Click “Borrow” to create your position.

The minimum borrow amount is 1,800 MUSD. Once you input your desired loan amount, you will see the terms of your loan:

- Collateral (paid in BTC)

- Collateralization ratio (all loans below 110% CR are eligible for liquidation)

- Annual interest rate

- Liquidation price (estimated price of BTC when you would be liquidated)

- Liquidation reserve (paid back when your loan is closed)

Opening up an MUSD loan

Once you confirm the transactions, you can see your loan's live dashboard. It is essential to keep a close eye on your collateralization ratio to protect yourself against liquidation.

Key Bitcoin Loan Terms: Refinancing and Fixed Rates

When you open a loan, your interest rate is fixed at the current market rate and applies to your entire borrowing capacity. You can initially borrow less than your maximum amount and increase it later without triggering a refinance.

Understanding Your Maximum Bitcoin Loan Amount

Your maximum borrow amount is set when you open your loan and remains fixed for its entire duration. It’s calculated based on the price of Bitcoin and the amount of BTC you deposit as collateral. Specifically, it equals the amount of MUSD debt that would bring your position to a 110% collateralization ratio at the time of loan creation.

You don’t need to borrow the full amount upfront. You can start small and borrow more later—up to that fixed maximum—without changing your interest rate.

Take the following example:

BTC Price: $100k

Collateral Deposited: 10 BTC

Maximum Borrow Capacity: 900k MUSD

So, let’s say you deposit $1M worth of BTC and only borrow 2,000 MUSD initially. You’d still have access to the full 900,000 MUSD credit line at a fixed 1% interest rate—ready to use when and if you need it. All you need to do is maintain a healthy collateralization ratio to protect against liquidation.

This gives you access to market-leading capital at your fingertips—for real-world spending, onchain opportunities, or anything else that requires low-cost liquidity.

And soon, with upcoming MUSD integrations and improved offramping options, you’ll be able to use that capital even more seamlessly.

Actions That Don’t Trigger Bitcoin Loan Refinancing

- Adding collateral: If BTC price decreases or you want to increase your collateralization ratio, you can add more BTC collateral to your loan position without impacting your interest rate.

- Withdrawing collateral: As long as your individual collateralization ratio and the system-wide health permits.

- Partial repayment: Pay back part of your MUSD loan, which will decrease the debt you are being charged interest on and increase your collateralization ratio.

- Borrow more MUSD: as long as the total borrowed amount stays within the maximum based on your initial collateral and BTC price at loan opening.

When borrowing more MUSD, you will pay a new issuance fee, but your fixed interest rate stays the same.

Step 3: Spend Your Bitcoin Loan (MUSD) in the Mezo Market

With MUSD in hand, it's time to explore the Mezo Market. You can:

- Buy hardware wallets like Ledger Nano X and Stax devices

- Support nonprofits like Brink and SheFi

- Purchase gift cards through Bitrefill for everyday spending

Your Bitrefill gift card purchases are directly applied to your Bitrefill account and seamlessly paid for with MUSD,

Below, you can see a transaction of MUSD → Bitrefill → Doordash. If Bitcoin goes up another 2x, your lunch will be completely paid for thanks to the near-zero cost of capital.

And yes, it’s true: Mezo founder Matt Luongo financed his burrito with MUSD at BTC Vegas.

More utility is on the way. Soon, you’ll be able to:

- Swap MUSD for more BTC (to lever long)

- Swap into USDT

- Trade perpetuals via Velar

- Send MUSD to exchanges for direct offramping

BTC -> MUSD -> Bitrefill -> Doordash

Eating a burrito shouldn't mean selling your BTC.

— Mezo (@MezoNetwork) June 3, 2025

Last week @mhluongo made history on the Bitcoin Vegas stage. pic.twitter.com/QgJG70uonk

Bitcoin-financed burritos

While Bitcoin-financed burritos are certainly delicious, our eyes are set on bigger items: a boat, your dream house, your child’s college tuition payments.

Bitcoin is the best collateral on earth, but it hasn’t been treated this way in capital markets.

Today, MUSD lets you access your Bitcoin wealth without destroying it, and soon, as additional integrations and features are released, you’ll be able to spend MUSD just like you do with the money in your bank account.

Step 4: Repay Your Bitcoin Loan and Reclaim BTC

Once you are ready to repay your loan, go back to the “Borrow” tab and click the “Manage loan” drop-down menu at the top right.

You have the option to partially or fully repay the MUSD debt here. We’ll select the full repayment.

Of course, if you have spent your MUSD, you’ll need to acquire additional MUSD to repay the loan. Later this month, a new “Mezo Swap” feature will allow you to swap directly from different stablecoins (USDT, USDC) into MUSD, so you can fully repay your outstanding debt.

Once you’ve repaid your loan, your Bitcoin will be returned to your account.

Closing your loan

And just like that, you’ve banked on yourself — no selling your Bitcoin, no giving up custody to an off-chain 3rd party. Everything on Mezo is done transparently onchain, is completely permissionless, and accessible 24/7.

Start Borrowing with Mezo's Low Bitcoin Loan Rates

Mezo is for anyone who believes money should serve people. Your Bitcoin can finally work without selling it. Borrow MUSD at 1% fixed rates, spend it, and keep your Bitcoin exposure. Available now at mezo.org/overview.

Mezo makes Bitcoin work like money. Now, let Mezo work for you.

🏦 Start borrowing • 📚 Read the docs • 💬 Join Discord • 🛡 View audits

Let's build the circular Bitcoin economy. Follow @MezoNetwork

FAQs

What are Bitcoin loan rates and how are they determined?

Bitcoin loan rates refer to the interest charged when you borrow funds using Bitcoin as collateral. These rates vary by platform and are typically influenced by factors like market demand, platform liquidity, and your loan-to-value (LTV) ratio. On Mezo, borrowers can access a fixed 1% interest rate — one of the lowest in the market — for a limited time. This rate is set through protocol governance and is applied to the entire loan duration once the position is opened.

Is it safe to take a crypto loan with Bitcoin as collateral?

Taking a crypto loan is generally safe if you're using a reputable, transparent, and secure platform. Mezo offers onchain, permissionless borrowing, which means you retain full custody of your BTC through smart contracts. However, there are risks, especially related to price volatility. If Bitcoin's value drops too much, your position could be liquidated unless you add more collateral.

What happens if the value of my Bitcoin drops after I take out a loan?

If the price of Bitcoin decreases significantly, your collateralization ratio may fall below the liquidation threshold (110% on Mezo). If that happens and you don’t act quickly, your loan could be liquidated to protect the system. To avoid this, Mezo lets you monitor your live position and add more BTC to stay above the minimum requirement.

Can I get a crypto loan without selling my BTC?

Yes. Platforms like Mezo let you borrow against your Bitcoin holdings without needing to sell them. This means you can access liquidity (in the form of MUSD) while still maintaining your Bitcoin exposure — ideal for long-term holders who want to avoid triggering capital gains taxes* or losing upside potential.

What is the loan-to-value (LTV) ratio in Bitcoin loans?

The LTV ratio represents the amount of your loan compared to the value of your Bitcoin collateral. For example, a 110% collateralization ratio means you must deposit $110 worth of BTC for every $100 you borrow. On Mezo, the user sets their collateralization ratio, but it can be adjusted over time.

How do I repay a Bitcoin-backed loan on Mezo?

To repay a Bitcoin-backed loan on Mezo, simply return the borrowed MUSD through the Mezo dApp. Once the full amount (including any accrued interest) is repaid, your locked BTC collateral will be automatically released and made available for withdrawal. You can also make partial repayments to reduce your debt and improve your collateral ratio. Be sure to monitor your position to avoid liquidation if BTC value drops. All repayments and interactions happen directly on Mezo's EVM-compatible Bi, using BTC as native gas.

*Disclaimer: The information provided in this post is for general informational purposes only. It does not constitute legal advice, investment advice, or other type of advice. Please consult with a qualified professional. The stated interest rate is fixed for the duration of an individual loan agreement once executed. However, the initial interest rate offered at the time of origination is subject to change and may vary based on prevailing market conditions, protocol parameters, and liquidity availability. Mezo does not guarantee the availability of any specific rate until a loan is finalized.