How to Save & Use Bitcoin for Retirement

Break free from fiat retirement traps. Mezo lets you earn yield on real BTC, borrow against it tax-free, and access liquidity without selling. No custodians, no ETFs, no capital gains—just sovereign, Bitcoin-native retirement. Start building your future at mezo.org.

There’s a hidden flaw in your retirement plan.

For decades, retirement planning has been a checklist of legacy finance assumptions. Open an IRA. Buy some mutual funds. Tolerate fees. Wait. The entire system is a fiat trap, designed to do one thing: keep you dependent on a currency that silently loses its value.

You're forced to trade the world's hardest money—Bitcoin—for paper promises and tax-sheltered cages that strip you of your sovereignty.

Mezo breaks that pattern. We’re re-engineering the very idea of a retirement account using Bitcoin as the base layer. This is your guide to building a future where you never have to sell your BTC.

Why Traditional Retirement Plans Don’t Work for Bitcoin Holders

IRAs, 401(k)s, and retirement brokerages are built around fiat rails. They limit what you can hold, charge fees to “diversify,” and force your Bitcoin into synthetic, fiat wrappers. If you want exposure to BTC, you get a trust. Maybe an ETF. Never the asset itself.

- The Custody Trap: A crypto IRA sounds modern, but it's a clever disguise for the same old problem. To get the "privilege" of a tax break, you must surrender your keys to an IRA provider.

- The Forced-Selling Penalty: When you reach retirement age and need cash, your only move is to sell. This triggers a capital gains tax event, punishing you for your long-term conviction and forcing you back into the fiat system.

- The Inflation Tax: Your retirement savings are denominated in a currency designed to depreciate. While the S&P 500 might offer returns, you’re still fighting a losing battle against inflation, the biggest hidden fee of all.

The institutions have identified the right asset but are being forced to use the wrong vehicle. You don't have that limitation.

Why The Institution’s Bitcoin Isn't Your Bitcoin

The quiet capitulation has begun. The institutions are finally here.

In a landmark move, the State of Wisconsin’s pension fund plowed over $160 million into Bitcoin ETFs. Let’s be very clear: this was a state pension, a bastion of conservative, long-term thinking, giving an institutional seal of approval to Bitcoin as a legitimate treasury asset.

This is the starting gun. Every pension fund manager in the country took note. The signal is clear: holding Bitcoin is a fiduciary necessity.

But here is the critical distinction: They didn't buy Bitcoin.

They bought shares in an ETF. They bought a paper promise, a financial vehicle that gives them price exposure without property rights. They hold a regulated IOU from BlackRock, not the underlying asset itself. Their shares are locked in a traditional brokerage account, unable to be used, moved, or controlled outside of stock market hours. They own a shadow, not the object.

This reveals the two paths for a Bitcoin retirement strategy:

- The Institutional Path (The ETF): A regulated, custodied, passive instrument. It's Bitcoin with a leash on it, designed for entities too slow and constrained to handle the real thing. It offers price exposure, and nothing more.

- The Sovereign Path (Direct Ownership): Holding actual BTC. This path gives you price exposure, as well as true property rights.

While their ETF shares sit idle on a balance sheet, your real Bitcoin on Mezo is alive. It can be used as collateral, generate yield, and be an active, functional part of your financial life.

They are buying a ticket to the show, while you can own a piece of the stage. This is the fundamental advantage they will never have, and it’s the cornerstone of a true Bitcoin for retirement.

The Mezo Retirement Blueprint

Let’s now examine practical steps for a Bitcoin retirement strategy on Mezo. The process is divided into two simple phases: accumulation (during your working years) and accessing capital (during your retirement years).

Phase 1: The Working Years

In the past, your retirement funds were locked away in an IRA account, held by a third-party custodian, and were completely unproductive outside of market price movements. The Mezo model is different from the ground up.

- You Deposit BTC: You connect your wallet to Mezo and deposit your Bitcoin into your personal, onchain vault.

- Your BTC Works for You: You start earning when your BTC is deposited. Once deposited, your BTC earns yield through Tigris—Mezo’s onchain incentive system. Or take your tBTC, cbBTC, or WBTC into the Upshift vault to start earning native rewards. The vault mints MUSD using your BTC as collateral and allocates it into Mezo DEX liquidity pools, the Savers Rate, and Tigris. You earn mats, partner points, and liquid yield—fully automated, no active management required.

This is the difference between an idle asset in an IRA and a productive one on Mezo—you get the benefit of a sophisticated, multi-layered yield strategy that is completely automated.

Phase 2: The Retirement Years

Now, let's fast forward. Imagine you’ve reached your retirement age. You have 2 BTC saved, and let's say the market price of Bitcoin is $200,000, making your retirement portfolio worth $400,000. You need $4,000 for your monthly expenses.

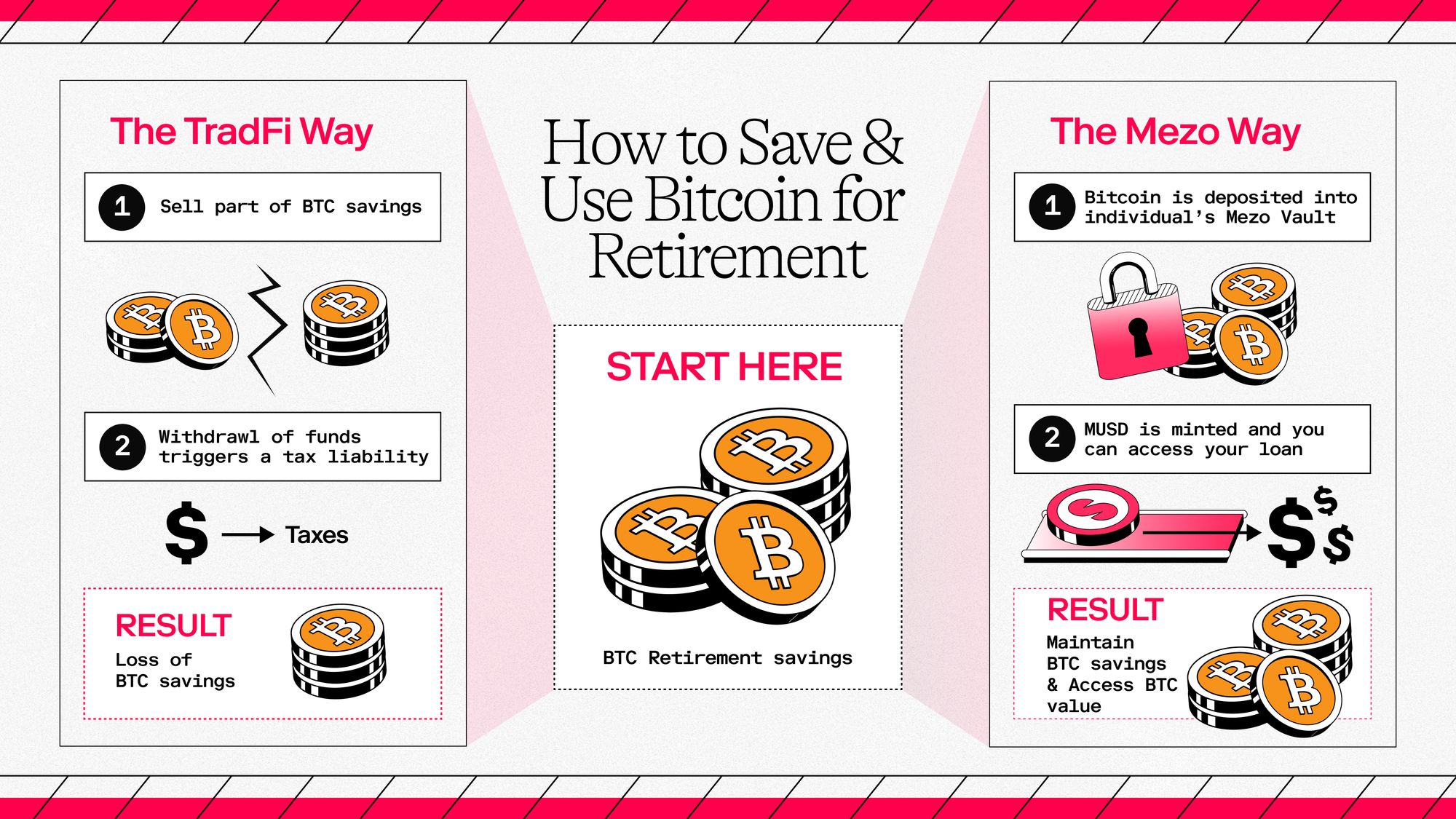

Here’s a side-by-side comparison of the old way versus the Mezo way.

The TradFi Way (The Fiat Trap): You would call your broker or log into your IRA provider account. You’d have to sell approximately 0.02 BTC. This triggers a capital gains tax liability on decades of appreciation. You wait days for the funds to settle, and you are now permanently poorer in BTC. You have sold a piece of your future.

The Mezo Way (The Bitcoin-Native Solution): With Mezo, you don’t sell. You borrow.

- You Open Your Mezo Position: You see your 2 BTC, worth $400,000.

- You Mint MUSD: Instead of selling, you open a loan. You mint 4,000 MUSD (pegged 1:1 with the US dollar) against your Bitcoin collateral. This instant Bitcoin-backed loan happens onchain in seconds, not days.

- You Spend Your MUSD: The 4,000 MUSD is now liquid in your wallet. You can use it directly in the Mezo Market, swap it for other assets, or use it to pay for everyday expenses like rent/mortgage, groceries, or travel.

- You Keep Your Bitcoin: After the transaction, you have the $4,000 in cash you needed. Your position still contains your original 2 BTC. You have sold nothing. You have triggered no taxable event. You retain your full exposure to any future potential for growth in Bitcoin.

The only cost is a small, transparent, fixed interest rate on the 4,000 MUSD you borrowed and any negligible gas fees. You can repay that MUSD loan on your schedule or keep it open as long as your collateral remains healthy.

Start Building Your Bitcoin Retirement in Minutes

Leaving the fiat system behind has never been simpler. There are no applications, no credit checks, and no advisors taking a cut.

- Connect Your Wallet: Visit mezo.org.

- Deposit BTC: Secure your Bitcoin in your Mezo vault.

- Watch it Grow: Your BTC immediately starts earning onchain incentives.

- Access Liquidity: When you need it, borrow MUSD instantly.

FAQ – Your Bitcoin Retirement Questions, Answered

Can Mezo replace my traditional retirement account?

Yes. Mezo is a self-sovereign, Bitcoin-native alternative designed for those who believe in Bitcoin's long-term value and want to avoid the traditional fiat system.

Is MUSD a safe way to fund my retirement?

Yes. MUSD is a stablecoin backed by over-collateralized Bitcoin. It provides dollar-denominated liquidity without the risks and dependencies of the traditional banking system.

How is my Bitcoin secured for the long term?

Mezo is built on the fully audited tBTC protocol and transparent smart contracts.

Can I really get cash in retirement without selling?

Yes. That is the core innovation. By borrowing against your Bitcoin, you access the liquidity you need without incurring capital gains or giving up your position.

What are the tax advantages of this strategy?

The ability to borrow against assets is a powerful tool for tax planning, as loans are not considered income and do not trigger capital gains.

This sounds better than a crypto ETF or IRA. What’s the catch?

There is no catch. This is simply a better-designed system. The only requirement is a belief in Bitcoin as the future of money and a desire to control your financial destiny.

Let's build the circular Bitcoin economy. Follow @MezoNetwork

🏦 Start borrowing • 📚 Read the docs • 💬 Join Discord • 🛡 View audits

Disclaimer: References to expected yields, APY, or other performance metrics are based on current performance and protocol parameters. Actual returns may be subject to change due to market conditions, protocol governance decisions, and other risk factors. Users are responsible for carrying out their own due diligence before choosing a Vault, and for monitoring any changes made to the Vault over time, particularly those subject to a time lock.