Introducing: Mezo Earn

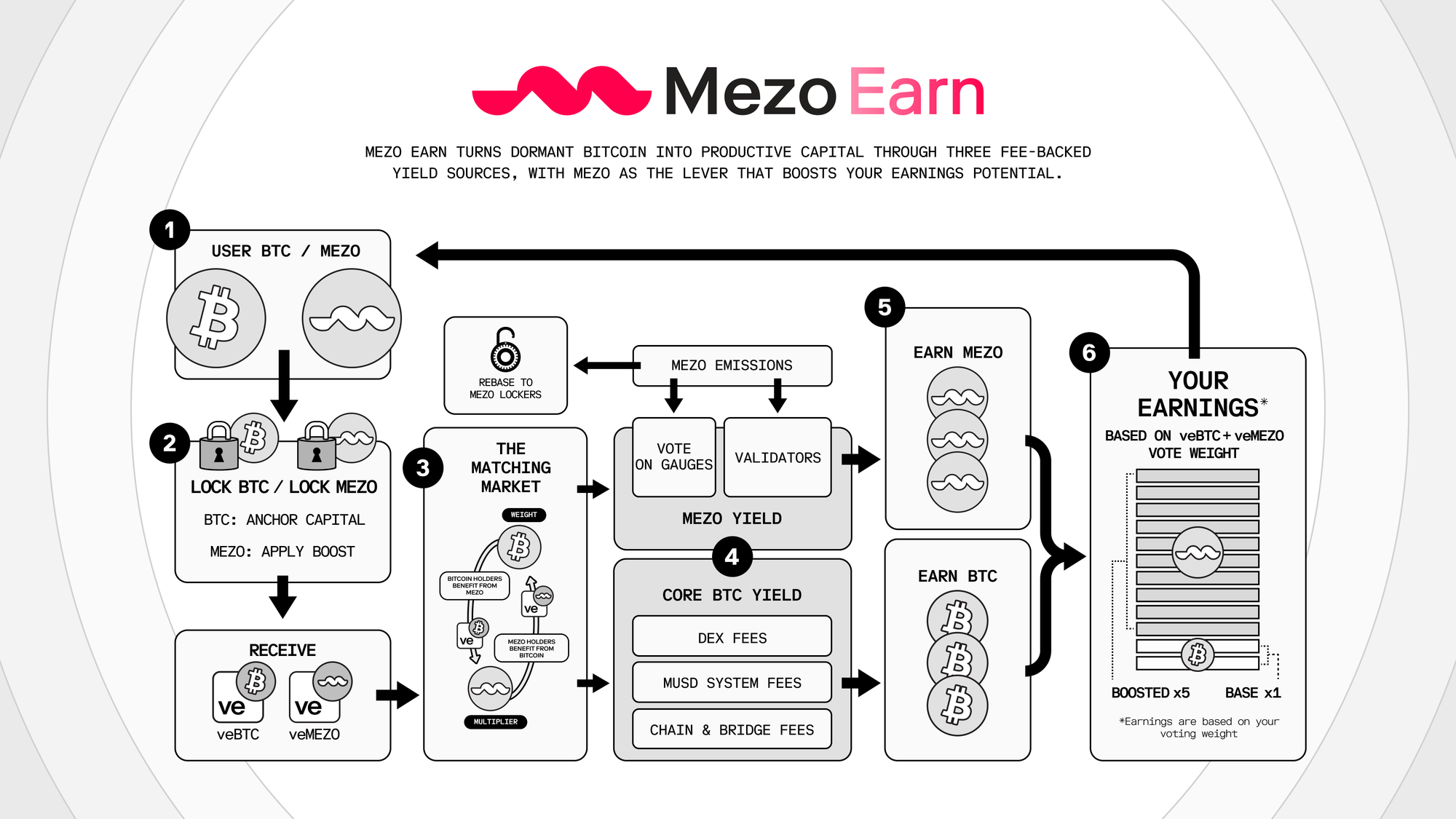

Mezo Earn introduces a Bitcoin-native incentive framework where locked BTC earns BTC-denominated fees, directs value flows, and participates in a decentralized, self-custodial financial system.

Bitcoin has spent a decade proving it can hold value. It hasn't yet proven it can do much else. The options look the same as they did years ago: wrap it, hand it to a centralized lender, or leave it idle. Wrapped assets fracture across bridges and issuers, each with different risk models. Centralized lenders work until they don’t. And staying entirely onchain yields nothing, which leaves a trillion-dollar asset unable to participate in the economic activity orbiting it.

Mezo was built to change that. Mezo is a decentralized network designed for a self-custodial BTC banking experience.

Lock bitcoin as collateral, and borrow MUSD (Mezo’s bitcoin-backed stablecoin) against it. That lets them keep BTC price exposure while accessing dollar liquidity for trading, saving, or spending. With the rails in place, the next step is letting Bitcoin holders earn from the activity they power.

Introducing Mezo Earn, an economic incentive framework built for Bitcoin-native finance.

Prime Access BTC Yield: Live Now.

Fundamentals of Mezo Earn

To be sustainable, a Bitcoin-native DeFi ecosystem must:

- Attract and retain deep liquidity in BTC and stablecoin pairs.

- Support a competitive stablecoin savings rate.

- Ensure the sustainability of itself through native fees.

Mezo Earn is built around explicit coordination, and MEZO is the mechanism that enables it.

MEZO is the Mezo Network’s coordination asset.

MEZO functions as the instrument that routes incentives, adjusts parameters, shapes liquidity, and captures the execution value generated by the chain. Mezo Earn translates MEZO’s role into a working market. Key to this system is that BTC remains the anchor of governance, while MEZO provides the precision and amplification that a dynamic system requires.

The intuition for this dual token economy stems from the Curve Wars. Curve never intended to create a public incentive battleground, yet its voting and emissions model made influence something users were willing to compete for. Convex emerged, vote-escrow positions turned into strategic assets, and suddenly, the value of liquidity incentives became a market with an observable price. It was chaotic, imperfect, and extremely revealing. The lesson was not copy Curve, but rather capital coordinates when you give it levers that matter.

Mezo Earn takes that lesson and applies it to Bitcoin.

Bitcoin Yield in Mezo Earn

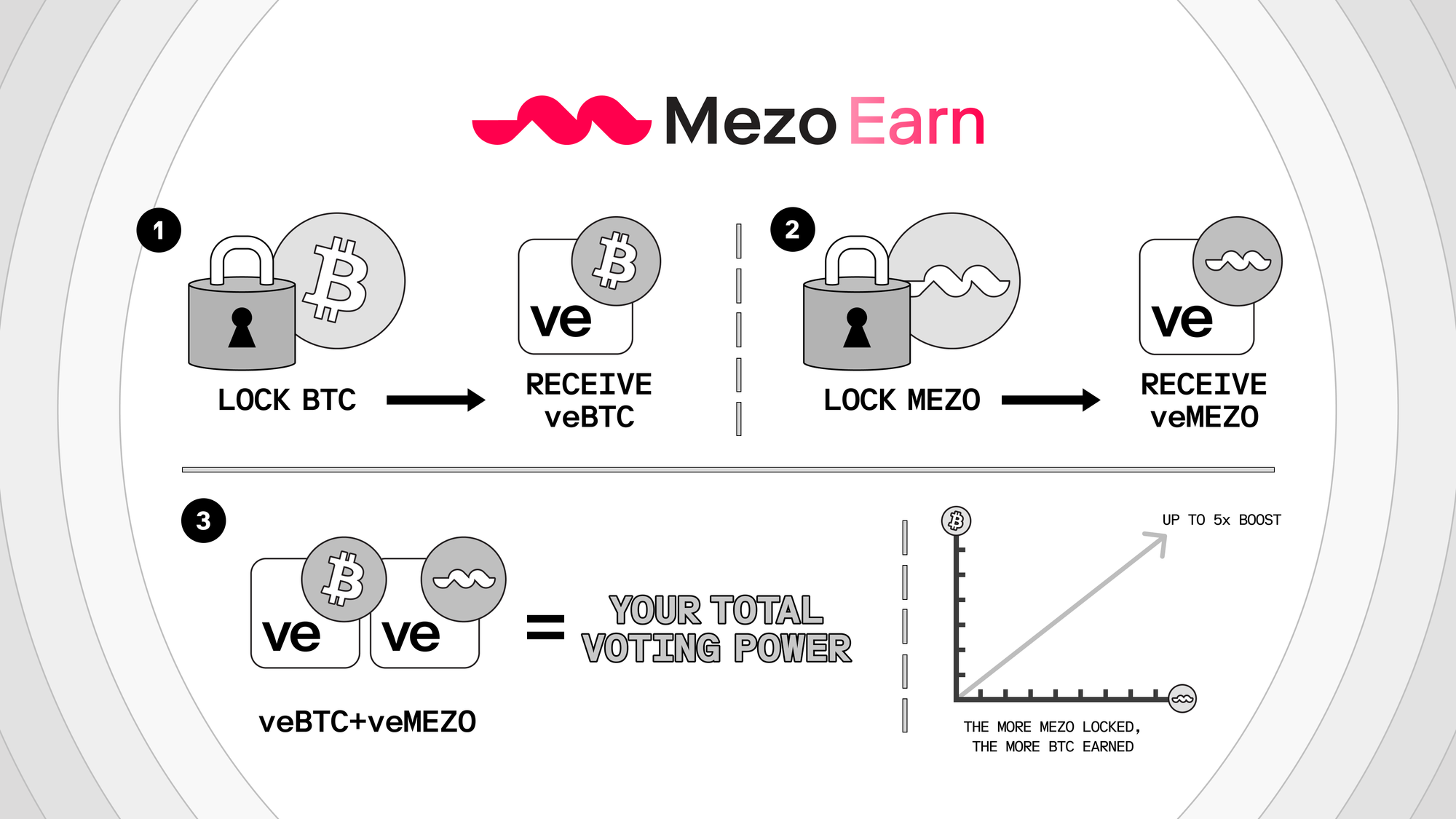

When users lock BTC, they receive veBTC—time-weighted voting power.

→ veBTC earns BTC-denominated fees.

→ veBTC directs fees.

veBTC is a position that earns in BTC. veBTC holders receive a share of the chain’s BTC-denominated fees automatically, proportional to their locked position. As the network processes swaps, borrowing, and bridging, these fees accumulate and route directly back to veBTC holders.

This is the base case yield on Mezo Earn.

Each epoch, veBTC voters determine how the network’s broader fee and reward flows should be allocated to specific opportunities. The more a user wants to influence where yield appears they can increase their influence through MEZO.

Scaling BTC Influence with MEZO

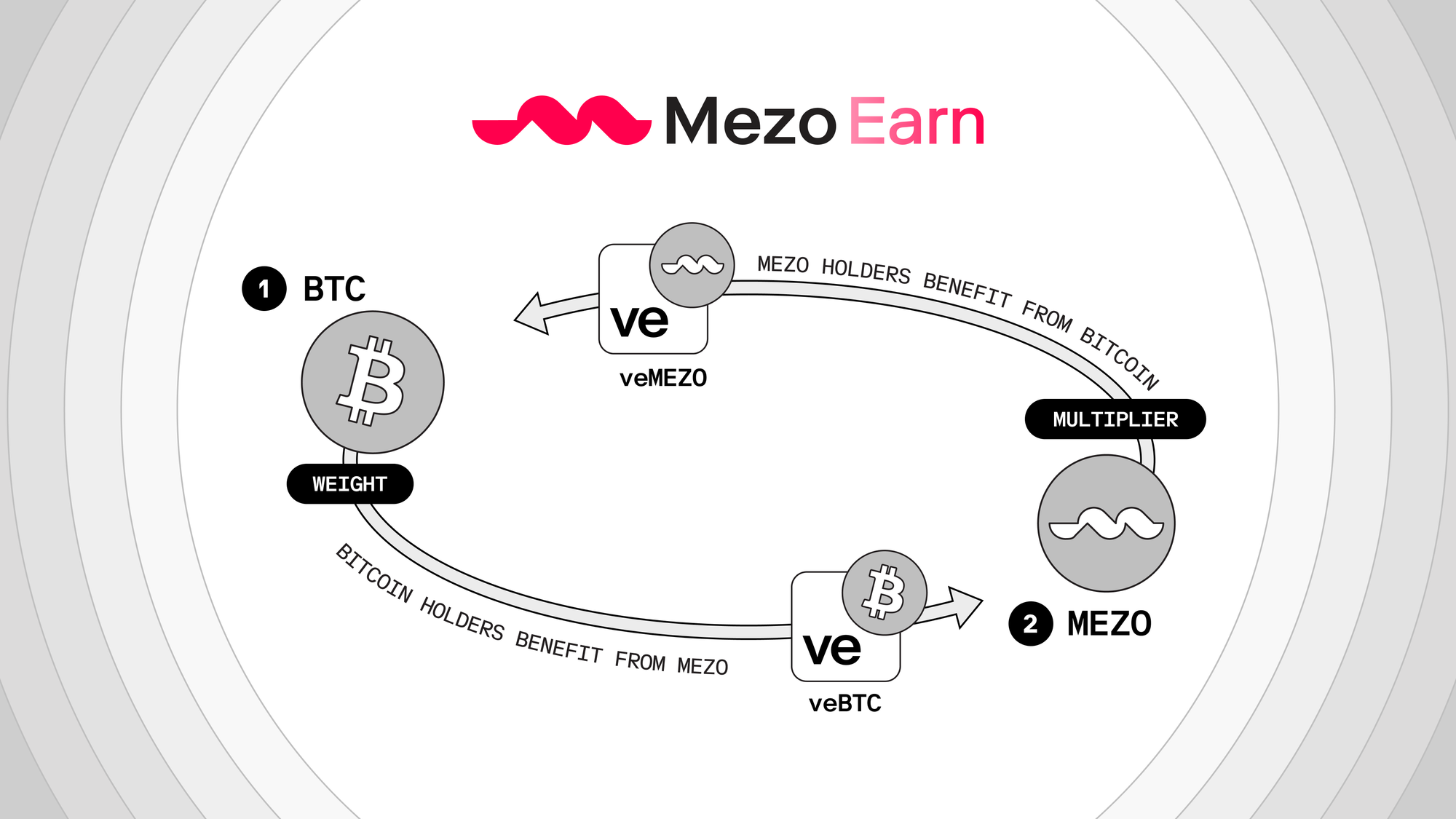

MEZO is a tool that allows BTC holders to amplify their influence over the protocol. When locked as veMEZO, it increases the effective weight of a user’s veBTC position. By voting to direct protocol and rewards flows, they can capture larger portions of fees generated in the pools or gauges they support. In this sense, veMEZO may function as a boosted position on bitcoin utilization.

The combined voting weight of veBTC and veMEZO results in what is known as a Boosted Weight. It is a mechanism for amplifying a BTC position’s ability to direct fee flows in the areas it supports.

The boost depends on a user’s relative share of the total veBTC and veMEZO supply. The boost scales with relative exposure. Larger BTC positions require correspondingly greater MEZO exposure to reach the maximum multiplier. Additionally, because boost is bounded, MEZO never overrides Bitcoin as the governance anchor; it only changes how effective a BTC position is in the economic game of directing value.

In practice, this mechanism allows MEZO to optimize the capital efficiency of a Bitcoin position, ensuring that the asset’s productivity matches the user’s contribution to governance.

How Value is Routed in Mezo Earn

To allocate fees and rewards, Mezo uses “gauges.” A gauge is a contract that receives fees or emissions and distributes them to the users who allocated votes to it. Different gauges correspond to different parts of the system:

→ Liquidity pools

→ The MUSD savings rate

→ Validators

→ Ecosystem programs

→ Individual veBTC positions

Gauges transform user preferences into measurable routing of value. They make fee distribution credibly neutral in that whoever contributes capital and commits votes to the system helps determine where returns flow.

The routing of emissions follows a similar logic of controlled adaptability. Instead of pouring inflation directly into pools, Mezo uses a governed splitter hierarchy to decide how much of each epoch’s emissions go to validators, liquidity providers, the MUSD savings rate, or ecosystem development. Each branch can move only gradually, preventing abrupt reallocations that destabilize participation. Rewards may shift over time toward activities that generate BTC and MUSD fees, reducing reliance on inflation as the system matures.

Mezo Earn’s Matching Market

In Mezo Earn, boosted weight is not a side-effect of holding two assets at the same time, but instead an explicit market between BTC and MEZO.

When a user locks BTC, the system creates an individual veBTC gauge for that position. veMEZO holders may then choose which of these gauges to support with their voting weight, and the amount of veMEZO directed to a gauge becomes the boost factor for that specific BTC position. This turns boosts into something users may compete for, rather than something they receive automatically. A BTC-heavy user who wants higher influence can attach incentives to their gauge to attract veMEZO votes, while a MEZO-heavy user might scan the set of gauges to find those offering the best incentive yield. Because boost is based on relative shares of veBTC and veMEZO, larger BTC holders receive less incremental benefit from small amounts of MEZO, forcing them to either acquire more MEZO or pay incentives over multiple epochs to maintain a high multiplier.

This structure effectively creates a permissionless marketplace for influence.

- The Demand Side: A BTC-heavy participant wants a higher yield multiplier. They post incentives on their personal veBTC gauge.

- The Supply Side: A MEZO-heavy participant wants to maximize their incentive earnings. They scan the market for the highest-paying gauges and direct their votes to capture the best possible return.

BTC holders do not need MEZO to participate in Mezo Earn at the base level—they always retain unboosted voting rights and earn BTC-denominated chain fees—but MEZO enables them to amplify their impact. MEZO holders, in turn, do not need BTC to earn from the system; they can direct votes toward veBTC gauges that pay attractive incentives.

This dynamic allows the distribution of voting weight to shift in response to changing incentives. Gauges presenting higher allocations naturally attract veMEZO participation, while those with lower engagement see a corresponding reduction in weight.

Be the First to Earn

Mezo Earn is live. The first 50 BTC to bridge, stake, and vote secures Prime Access rates. Read the full Prime Access guide here.

The Mezo Earn Economic Thesis

Mezo Earn turns Bitcoin into an active economic participant by anchoring governance and value flow directly to locked BTC, while using MEZO as the mechanism that scales and directs that influence.

By pairing the Bitcoin (veBTC) with MEZO (veMEZO), the network creates a permissionless market for influence where yield, liquidity, and incentives are priced in real time. BTC provides the base weight and earns BTC-denominated fees by default, while MEZO supplies bounded amplification that must be earned or acquired through market competition. Governance power cannot drift away from Bitcoin, emissions cannot overwhelm fee-based returns, and participation is rewarded in proportion to capital commitment.

This design ensures that while MEZO coordinates the incentives, Bitcoin retains the sovereignty, giving every holder the agency to stop merely saving for the future and start building it.

Read the full Mezo Earn Whitepaper here.

Disclaimer

Accuracy of Information. The information presented is for informational purposes only, and may not be complete. While every effort is made to ensure all information is accurate and up-to-date, no representations or warranties are made regarding the information provided herein, and the project expressly disclaims any representations, warranties, or covenants in any form to any entity or person.

Forward Looking Statements; Not Investment Advice. The materials may contain forward-looking statements regarding future events, milestones, tokenomics implementation, project development, protocol economics, and potential token utility. These statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. This document does not constitute professional, financial, or investment advice.

Risk Factors; Due Diligence Required. Participation involves risks and may result in the total loss of any contribution. Participants must conduct their own independent investigation and analysis of the project and all relevant matters. Seek advice from legal, tax, financial, and technical advisors regarding the risks and consequences of participation.