Loop Your Deposits for Boosted Earnings: upMUSD and solvBTC

Looping is DeFi's leverage play: deposit assets, borrow against receipt tokens, redeploy, and repeat to stack yields. Here's how to use Mezo's upMUSD, solvBTC, and Bitfire to amplify returns—plus the critical risks you need to understand before looping.

Want to know what 60%-100% APY looks like? Ask the depositors who showed up to Mezo's MUSD campaign in week one—before yields normalized to 30%.In DeFi, the earliest users get the best returns. And the window of opportunity doesn't stay open for long.

Mezo's yield ecosystem is live and growing fast, offering multiple ways to earn on MUSD, solvBTC, and upMUSD. The strategy that savvy users are starting to deploy? Looping.

Here's what looping unlocks:

- Amplified yields – Put the same capital to work multiple times across vaults, pools, and lending markets

- Maximum efficiency – Turn solvBTC into a yield-generating machine while maintaining BTC exposure

- Compounding rewards – Deposit MUSD, receive upMUSD, then redeploy that receipt token for additional yield layers

This post breaks down how looping works, who it's for, and how to get started 👇

Disclaimer: Looping involves leveraged positions which carry significant risks including liquidation. Users should fully understand these risks before participating. This content is for informational purposes only and should not be considered financial advice. Always do your own research and never invest more than you can afford to lose.

What Are Yield Loops?

Looping is a DeFi strategy that involves recursively depositing and borrowing against your assets to amplify yields. With the new upMUSD receipt token, you receive a composable asset when depositing MUSD into the Upshift Vault. This receipt token can then be used as collateral on Bitfire, enabling you to borrow more, deposit more, and stack multiple yield streams on the same initial capital.

Think of it as putting your money to work in multiple places at once—earning vault yields, pool fees, and capturing interest rate arbitrage opportunities simultaneously.

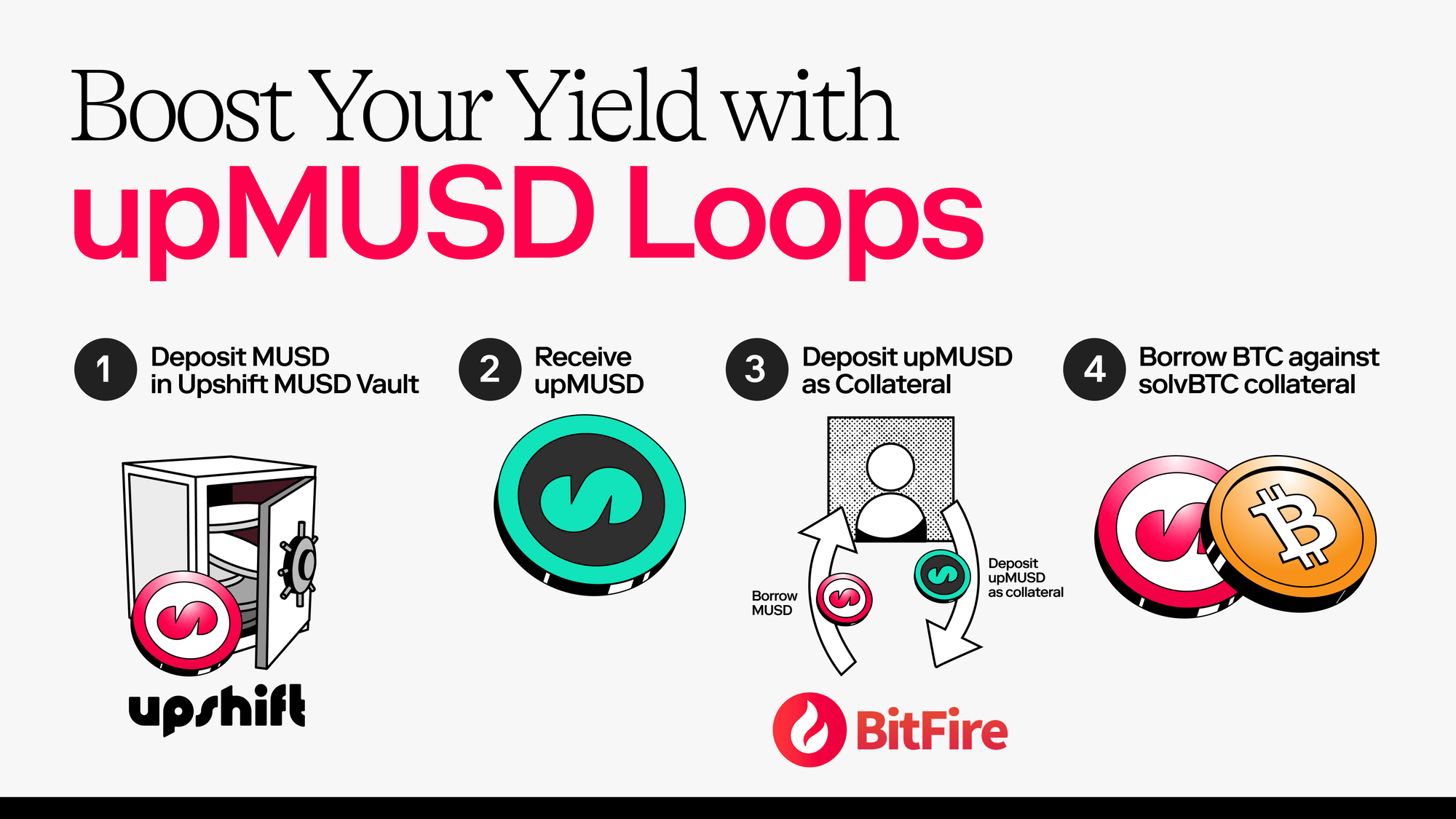

Strategy #1: The upMUSD Native Loop

Here's how to maximize your MUSD holdings directly on Mezo:

- Deposit MUSD into Upshift Vault → Receive upMUSD receipt tokens

- Borrow MUSD against upMUSD on Bitfire

- Redeploy borrowed MUSD into the MUSD vault on Mezo

- Repeat to build your leveraged position

The math is compelling: with Upshift Vault yielding approximately 30% APY and BTC borrowing costs at just 1%, you're capturing a significant spread. The beauty is that each loop builds on the last, creating a compounding effect that accelerates your returns over time.

As usual, first depositors get the best yield. As more assets are deposited into the MUSD vault, the yield can be expected to decrease.

Strategy #2: The solvBTC Power Play

solvBTC holders—your assets have been on Mezo since May, and now it's time to put them to work. We're offering gas rebates for ALL solvBTC transactions, so there's never been a better time to activate your position.

The MUSD Trove Loop

- Deposit solvBTC into Bitfire as collateral

- Borrow MUSD against your solvBTC position

- Deposit MUSD into Upshift Vault → receive upMUSD

- Use upMUSD tokens as fresh collateral on Bitfire

- Repeat to build your leveraged position

The BTC Collateral Loop

- Deposit solvBTC into Bitfire

- Borrow BTC against solvBTC collateral

- Mint MUSD with borrowed BTC at a fixed 1% rate

- Deposit into Upshift Vault → receive upMUSD

- Loop back using upMUSD as collateral

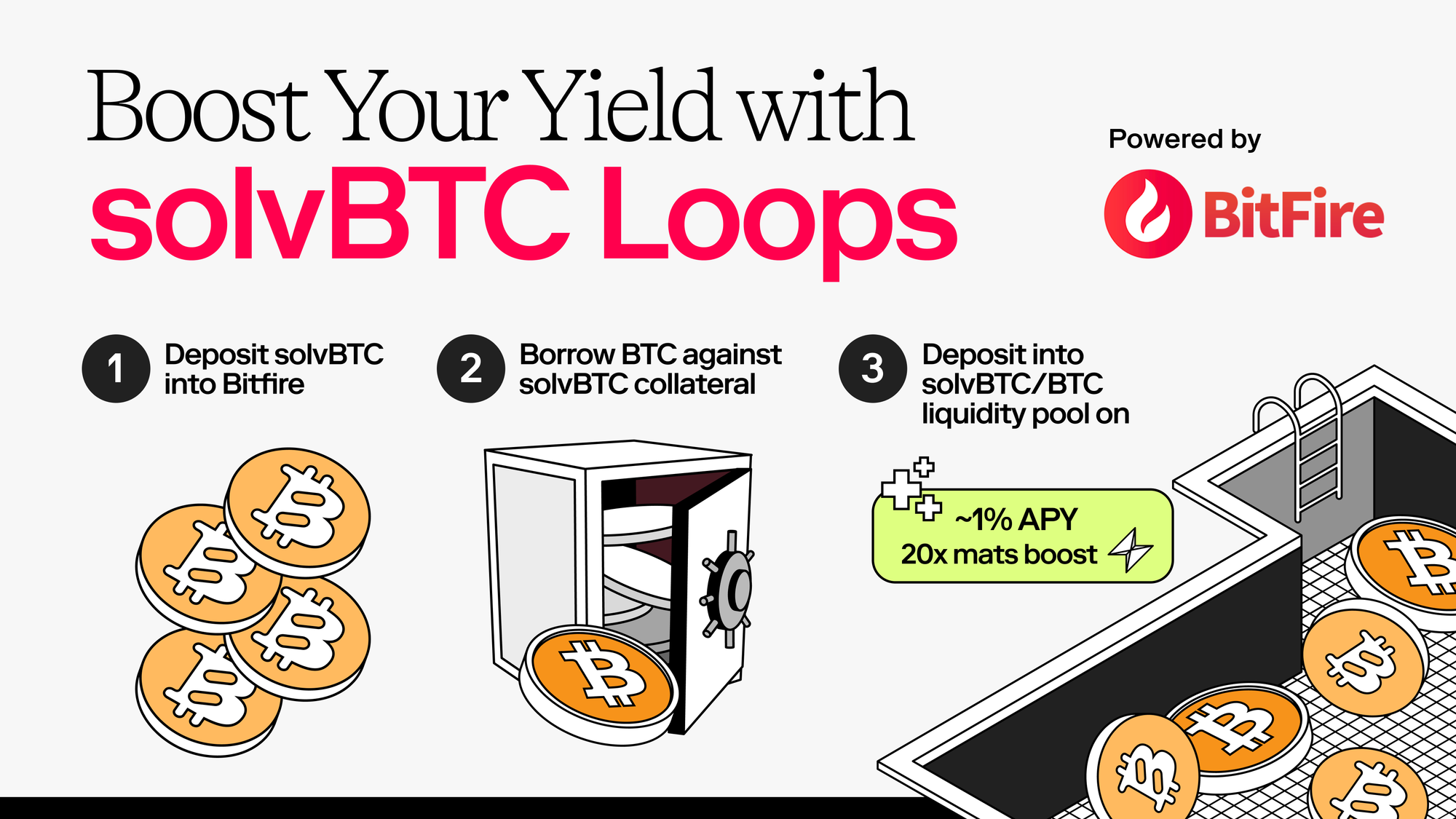

LP Strategy for solvBTC (Pictured Below)

- Deposit 50% of your solvBTC into Bitfire

- Borrow BTC against solvBTC collateral

- Deposit BTC/solvBTC into the Mezo Tigris pool

- Earn mats bonus rewards (viewable in Rewards Hub) and real fees from trading activity

Both strategies let you maintain exposure to solvBTC while generating additional yields across multiple protocols.

⚠️ Critical Risk Management

Looping creates leveraged positions. This is not risk-free.

When you loop, you're essentially borrowing against your collateral multiple times, which means your position can be liquidated if collateral ratios fall below safe thresholds. Each protocol interaction adds smart contract risk, and the complexity of managing multi-step strategies requires attention and understanding.

To stay safe, keep your loan-to-value ratios conservative, monitor your position health frequently, and always start with small test amounts before scaling up.

It is generally best practice to set price alerts for your collateral assets and maintain buffer capital for emergencies. Most importantly, never loop more than you can afford to lose, as leveraged positions can amplify both gains and losses.

Gas Rebate Details

Our gas rebate program covers ALL solvBTC holders on Mezo—it's our way of rewarding early supporters and ensuring you can participate in the Mezo ecosystem. Mezo uses BTC for transaction fees, so solvBTC holders will not be able to transact until they receive BTC from our gas rebate program. The rebate will be sent out in batches, effective immediately.

If you experience any issues viewing your BTC in your wallet, please let us know in Discord.

Start Looping Today

To begin looping on Mezo, you'll need MUSD, BTC, or solvBTC already on the platform. Check out our docs guide on how to get started.

The upMUSD receipt token transforms how you can use capital on Mezo. Whether you're maximizing MUSD yields through native loops or finally activating that solvBTC position, the opportunity for enhanced yields is here.

Ready to loop? Start with the upMUSD vault and experience the power of composable yield for yourself. solvBTC holders, please reach out in Discord if you have any issues with receiving your gas rebate.

Start banking on yourself today:

- 🏦 Borrow at 1% fixed: mezo.org/borrow

- 📚 Read the docs: mezo.org/docs

- 👾 Join the community: discord.mezo.org

- 🕊 Follow development: @MezoNetwork

Bitfire Links

- 🕊 X: @bit_fire_

- 💻 Website: bit-fire.xyz

Disclaimer: References to expected yields, APY, or other performance metrics are based on current performance and protocol parameters. Actual returns may be subject to change due to market conditions, protocol governance decisions, and other risk factors. Users are responsible for carrying out their own due diligence before choosing a vault, and for monitoring any changes made to the vault over time, particularly those subject to a time lock.