Mezo 101: Liquidations & Redemptions

Confused by Mezo liquidations? Learn how Mezo’s Bitcoin-backed stablecoin MUSD stays on peg: borrow at fixed rates, understand liquidations (ICR <110%) and redemptions ($1 MUSD = $1 BTC), and steps to avoid liquidation—bank on yourself with confidence.

Welcome to Mezo 101—your starting line for Everyday Bitcoin Finance. Whether you’re minting your first MUSD or optimizing a seasoned position, these guides help you confidently navigate your Bitcoin future.

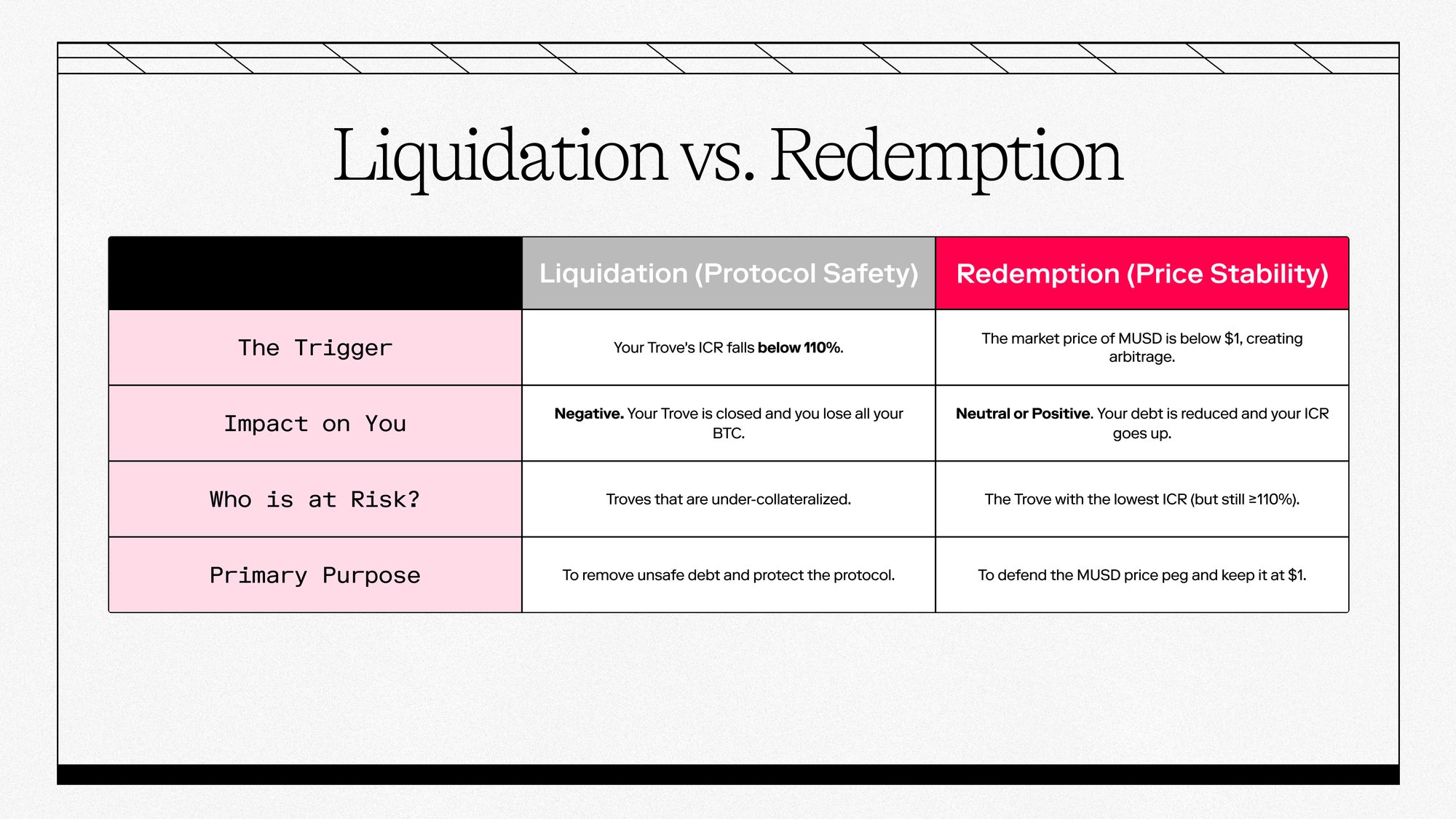

The reliability of Mezo’s Bitcoin-backed stablecoin MUSD rests on its ability to maintain both its full backing and its $1 price peg. This is engineered through two complementary forces: liquidations and redemptions.

Liquidations are the solvency guardrail ensuring the total value of collateral in the system always exceeds the total debt. This process is essential for any stablecoin built on a Collateralized Debt Position (CDP) model, as it guarantees MUSD is always fully backed.

Redemptions provide the arbitrage mechanism that firmly locks MUSD's market price to its $1 peg.

These two mechanisms have different purposes and outcomes for you as a borrower.

Liquidations

Mezo lets you mint mUSD by opening a collateralized debt position against BTC. This position is called a Trove.

Every Trove has an Individual Collateralization Ratio (ICR). This is simply the ratio of the value of your BTC collateral to the amount of MUSD debt you owe.

Liquidation is the automatic response when a Trove’s ICR drops under the 110% minimum. Because the interest model is simple interest, your entire debt increases linearly over time; if you do nothing, your ICR drifts down when BTC is flat.

ICR is calculated as (BTC collateral × BTC/USD oracle price) ÷ entire debt, where “entire debt” includes principal, simple (non-compounding) interest, issuance/refi fees, and the 200 MUSD gas buffer added at borrow time.

The price that marks your “tripwire” is your liquidation price = (1.10 × entire debt) ÷ BTC collateral.

For example, if you posted 1.0 BTC against $50,000 of the entire debt, your liquidation price is $55,000; any price below that makes your Trove liquidatable. As interest accrues, that threshold rises unless you repay.

What Happens When a Trove Crosses 110%

When a borrower’s ICR drops below 110%, anyone—typically a bot—can call the liquidation function. The liquidator receives 200 MUSD from the Gas Pool and 0.5% of the Trove’s BTC as a reward for performing the work.

On liquidation, the protocol checks the Stability Pool’s MUSD balance. If the pool holds at least the liquidated trove’s entire debt, it offsets the position: the pool burns that MUSD, takes 99.5% of the trove’s BTC, and the liquidator receives 0.5% of the BTC + 200 MUSD from the Gas Pool.

If the pool cannot cover the entire debt, the protocol routes to redistribution. Here, it moves the debt and the BTC to the Default Pool and assigns them pro rata to healthy troves (>110% ICR). Pool depositors can withdraw their remaining MUSD and accumulated BTC later.

Offsetting with the Stability Pool clears bad debt immediately without shifting risk to other borrowers and avoids changing their ICRs. Redistribution is a fallback only when the pool can’t be fully offset, ensuring the system remains solvent in all conditions.

The pool “buys” BTC at a discount. If a Trove owes 10,000 MUSD and holds $11,000 of BTC, depositors give up 10,000 MUSD and receive roughly $10,945 of BTC value after the liquidator’s cut—about a 9.45% discount. This incentive is why under-collateralized Troves clear quickly.

The key thing to remember here is: liquidiations happen when your position becomes unsafe.

Redemptions

A redemption is not a liquidation. A liquidation only applies to Troves below 110% and closes the Trove by seizing collateral through the Stability Pool or via redistribution.

A redemption is an entirely different mechanism designed to keep MUSD stable. Redemptions are triggered by market forces. When the price of MUSD on an exchange drops below $1, arbitrageurs can buy cheap MUSD, redeem it through Mezo for exactly $1 worth of BTC, and sell the BTC for a profit (minus a redemption fee). As of writing, the redemption fee is 0.75%; so redeeming 100 MUSD returns $99.25 worth of BTC to the redeemer and routes $0.75 of BTC to the protocol’s PCV. This buy pressure pushes the MUSD price back up to $1. For you as a borrower, it's a neutral or even positive event.

During redemption, the protocol must source the BTC from a borrower's Trove. It does this by selecting the riskiest healthy Trove—the one with the lowest ICR that is still at or above the 110% minimum.

Partial vs. Full Redemptions

Depending on the amount redeemed, the impact on the targeted Trove can be partial or full.

- Partial Redemption (The Most Common Scenario): Most of the time, a redemption will only cover a portion of a Trove's debt. In this case, your debt and collateral are reduced by the redeemed amount, your ICR goes up, and your Trove remains active and healthier than before.

- Full Redemption: In some cases, a large redemption might be enough to pay off a Trove's entire debt. When this happens, your debt is completely cleared, and any remaining BTC collateral is set aside for you as surplus. You can claim this surplus at any time.

Let's See It in Action

To see how this works, let's look at a partial redemption. Imagine two borrowers, Alice and Bob:

- Alice has a Trove with a 130% ICR ($1,300 in BTC for an entire debt of 1,000 MUSD).

- Bob has a Trove with a 200% ICR ($2,000 in BTC for an entire debt of 1,000 MUSD).

Because Alice has the lowest ICR, her Trove is first in line. Now, an arbitrageur redeems 100 MUSD.

- Debt Paid: 100 MUSD of Alice's debt was instantly paid off, and she now owes 900 MUSD.

- Collateral Sent: $100 worth of her BTC is sent to the redeemer (minus the fee). Her collateral is now worth $1,200.

Her new position is $1,200 in BTC against 900 MUSD of debt. As a result, Alice's ICR has increased to ~133%, making her position even safer.

Now, what if the arbitrageur had redeemed 1,000 MUSD instead? That would be a full redemption. Alice's entire $1,000 debt would be cleared, and she would be left with her remaining $300 worth of BTC collateral as surplus, which she can claim at any time.

Bottom line: If your Trove is redeemed against, your debt is reduced, and your collateral is reduced by the same value. The net effect is that your ICR increases, making your position safer. If a redemption pays off your entire debt, you can claim your remaining surplus BTC.

For a complete technical breakdown, please refer to our documentation.

How to Manage Your Position

The strategy for navigating both liquidations and redemptions is the same: maintain a healthy Individual Collateralization Ratio.

Treat 110% as the tripwire, not a target. Open with a buffer that fits your tolerance. Many borrowers operate between 150% and 200%, while 125–150% is possible but far less forgiving in fast markets.

A dangerously low ICR (< 110%) exposes you to liquidation. A low but healthy ICR (e.g., 110% - 130%) makes you the first in line to be redeemed against.

By keeping your ICR in a strong range (ideally 150% or higher), you protect yourself from liquidations and significantly reduce your chances of being redeemed against. You remain in complete control of your assets, allowing you to bank on yourself with peace of mind.

Ready to live on your Bitcoin?

MUSD Monitor

Keep Tabs on your Loan with MUSD Monitor

For advanced monitoring, you can use mezotools.cc.

This tool allows you to:

- Check real-time Trove health and Collateral Ratios.

- View recent system-wide redemptions and liquidations.

- Track BTC and MUSD prices directly from Mezo’s on-chain oracles.

FAQs

What exactly is in “entire debt”?

Principal + simple interest accrued + issuance/refinance fees + $200 MUSD gas compensation.

Does the protocol use the Stability Pool first?

Yes. The Stability Pool offsets liquidated debt first. Only if it lacks enough MUSD does the system redistribute debt and collateral via the Default Pool.

Can I be liquidated above 110%?

The liquidation trigger is ICR < 110%. In Recovery Mode, the liquidation process is the same. If you are liquidated with CR > 110% in RM, any surplus (collateral − 110% × debt) is claimable via BorrowerOperations.claimCollateral.

Do redemptions liquidate me?

No. Redemptions reduce your debt (and transfer out matching BTC) when your trove is among the lowest-ICR troves ≥110%. That typically raises your ICR afterward.

How is the redemption fee set?

Currently, it has been pre-set but will be governable in the future, as Mezo continues on its path to decentralization.

Is interest compounding?

No. Simple interest only.

Let's build the circular Bitcoin economy.

Follow @MezoNetwork

🏦 Start borrowing • 📚 Read the docs • 💬 Join Discord • 🛡 View audits

Disclaimer: References to expected yields, APY, or other performance metrics are based on current performance and protocol parameters. Actual returns may be subject to change due to market conditions, protocol governance decisions, and other risk factors. Users are responsible for carrying out their own due diligence before choosing a Vault, and for monitoring any changes made to the Vault over time, particularly those subject to a time lock.