The Dormant Rebel: From Silk Roads to Suits

From gold-backed money to fiat, from cypherpunks to Bitcoin—each era traded freedom for control. Bitcoin broke that cycle: scarce, decentralized, unseizable. Yet as it became digital gold, it stopped moving. The journey reveals one truth: open money thrives when it remains both sound and in motion.

Prologue: Ignition Sequence

When you're young, you dream in fire.

You speak a language of demolition and creation, of tearing down an old world built on brittle promises and raising something new from its foundations. For a moment, you even believe you can.

You have a driving sense of certainty that the systems you were born into are not immutable laws of nature, but aging constructs—heavy with contradictions and ripe for replacement. You see the cracks in the edifice. You feel an urgent, almost physical need to find an out. Not an escape, but a need to build anew.

This was the spirit that animated the early cypherpunks. It began as a rebellion against inevitability.

By the late 1980s, a small group of technologists sensed the coming collision between digital networks and personal freedom. They saw that as life migrated online, surveillance would become the default posture of states and corporations. Cash itself was no longer neutral; it was issued exclusively by central banks, inflated at will, and steered by policy decisions made in rooms the public never entered. Life was mediated through credit scores, account freezes, and payment networks that could deny service with a keystroke. A handful of elites sat at the choke points of both money and information, deciding who could participate and on what terms.

This control was never inevitable. It simply was the latest turn in the long story of gradual retreat from hard money.

For centuries, sound money meant redeemable money. Paper notes once represented gold held in vaults. That all ended in 1971, at Nixon’s behest. For the first time, global money became entirely unbacked. Supply could expand indefinitely; debt and inflation became policy tools. The world moved from redeemable wealth to printable wealth.

Once that link was broken, money lost its competitive check. Central banks held a monopoly over issuance, and that monopoly insulated them from market feedback. But history had already shown that money could be both stable and open.

In 18th-century Scotland, free banking allowed anyone with capital and credibility to issue notes. It worked brilliantly. However, those lessons were buried under a century of central banking monopolies that served elite interests.

The choice to centralize wasn't inevitable. It was deliberate.

The same story is playing out in the digital age. Cypherpunks were re-awakening a principle history had already proven: money thrives when it is open, competitive, and redeemable.

For decades, cryptographers tried and failed to invent unseizable cash: Chaum hinted at privacy, Back at proof-of-work, Szabo at digital gold. In 2008, Satoshi consolidated the ideas. Bitcoin became the first asset that was provably scarce, transferable without intermediaries, and alive outside the reach of any government.

Finally, the rebel was given a tool.

Yet from its birth, the rebel's tool faced its first test: would Bitcoin circulate like cash, or petrify into digital gold?

Over the years, new layers emerged — Lightning, sidechains, even experimental ideas like BitVM — each offering new ways to move value. But they never touched the deeper question. The problem was never how to spend Bitcoin, but why anyone would. When the asset is your vault of long-term security, the rational choice is always to spend fiat and keep your Bitcoin.

This is the tension at the heart of the story. The tool that promised everyday freedom became too valuable to use.

It is here, in the gap between money as control and money as freedom, that Mezo’s manifesto begins.

Chapter I: Proof of Use

The birth of Bitcoin was perfectly timed for its purpose.

On January 3, 2009, the network began. The genesis block's embedded message read: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." The 2008 Great Financial Crisis rudely taught that when risk socializes losses, account holders carry the cost. Bitcoin recognized this, as its design pushed the risk boundary outward to energy, time, and independent verification.

For a time, this revolution was quiet, confined to forums and mailing lists. But for a technology to prove its worth, it must be used.

On May 22, 2010, a programmer named Laszlo Hanyecz offered 10,000 bitcoins for two large pizzas. The transaction was completed. Those two Papa John's pizzas represented the first documented commercial use of Bitcoin. Bitcoin Pizza Day proved the system worked.

However, the Bitcoin whitepaper outlined a system designed to operate without trusted third parties. It needed testing in a real-world, high-stakes, adversarial environment where intermediaries could not be trusted and where censorship was a constant threat. That environment was the Silk Road.

Launched in February 2011, the Silk Road was an online marketplace accessible only through Tor, and it exclusively used Bitcoin. The combination of Tor's anonymity and Bitcoin's censorship-resistant transactions created the ultimate privacy toolkit. Although Silk Road shut down in 2013, it proved that decentralized, peer-to-peer currency could facilitate a global marketplace without relying on banks, governments, or payment processors.

The rebel's tool worked. But then something unexpected happened. Bitcoin proved too good to spend.

Every pizza became a regret. Taxes turned buying coffee into a spreadsheet. Scarcity made each coin worth more tomorrow than today. Volatility created merchant risk. Fee spikes created unpredictability. The Cantillon effect made spending irrational. The rational choice became clear: hold the hard asset, spend the depreciating currency.

Bitcoin launched as peer-to-peer electronic cash. It evolved into digital gold. This evolution was necessary. It proved Bitcoin's resilience and cemented its role as the hardest money in human history, secured by thermodynamic cost and mathematical scarcity.

The Silk Road demonstrated that Bitcoin could be circulated. The hodler proved Bitcoin could preserve wealth across time. But a new question emerged:

Could Bitcoin do both?

Chapter II: Weight and Motion

The same fate befell the rebel. Debt and dependency smothered youthful fire.

While Bitcoin was proving itself, the vast majority of people were unwittingly being pulled deeper into the system of control.

The cost of everything rose faster than wages could follow. Housing that once cost three years' salary now demands ten. Healthcare premiums doubled, then doubled again. Groceries, childcare, basic existence—all inflated while paychecks stagnated. In 2022, U.S. inflation peaked at 9.1%, a 40-year high, but the squeeze had been tightening for decades. This wasn't an accident or incompetence. This was policy. Print money, export inflation to those furthest from the printer, and watch them run faster on the treadmill.

Student debt became one particularly vicious manifestation—$1.8 trillion in non-dischargeable obligation, impossible to escape even through bankruptcy.

The rebel found themself working harder for less. Two jobs to afford what one job used to cover. Side hustles to patch holes in a sinking budget. The gig economy offering "flexibility" that really meant precarity.

Career paths became matters of survival, not vision. You couldn't afford to take risks when rent was due. You couldn't experiment with alternative models when healthcare was tied to employment. You couldn't build the new world when all your energy went to staying afloat in the old one.

The idealist rebel who once dreamed of tearing down the system now found themself fully enmeshed in it. They wore the suit. They optimized their resume. They played the game, telling themself it's temporary, until things stabilize, until they get ahead.

But they never got ahead. The treadmill only sped up.

The agent of change had been tested, stretched thin, forced into compromise. The weight of the old system pressed down, but with each added burden, the ember glowed hotter. Pressure does not only tame. Sometimes, it tempers.

The rebel learned something in those years of grinding: the system wasn't broken, it was working exactly as designed. And that realization, rather than crushing the fire, forged it into something harder. Something patient. Something preparing for the right moment, the right tool, the right catalyst.

Chapter III: Parallel Dormancy

In a strange parallel, as the individual rebel was trading their ideals for a salary and a 401(k), the tool of their rebellion was undergoing a similar transformation.

Bitcoin was putting on a suit of its own.

The journey from the fringe to the financial mainstream was gradual, then sudden. For much of its history, Bitcoin was dismissed by the establishment. Analysts at major banks suggested its true value could be zero. Yet as Bitcoin proved its resilience and its value climbed, the tide turned. Institutions that once scoffed began to take a strategic interest. Banks that called it "too volatile" later conceded it was "too important to ignore."

This institutional embrace reached its zenith on January 10, 2024, when the U.S. Securities and Exchange Commission approved 11 spot Bitcoin exchange-traded funds. The rebellion had officially been financialized.

The same corporations Bitcoin was meant to bypass now hoard it on their balance sheets. From MicroStrategy to Coinbase, billions in BTC now sit in corporate vaults. The currency born from a cypherpunk mailing list became a primary treasury reserve asset. The tool designed to operate outside the system had become a prized asset within it.

This very success created a new dilemma. As Bitcoin matured into an institutional-grade store of value, its utility as a medium of exchange for the average person began to atrophy. The dream of a peer-to-peer electronic cash system for daily use ran into a wall of practical challenges.

The result is a profound paradox:

- The rebel became a worker

- The tool became an asset

- The fire became an ember

Both the person and their Bitcoin are successful by the world's metrics. But both are fundamentally dormant. The revolution, it seems, has eaten itself.

However, embers don’t die easily, as we shall soon find out.

Chapter IV: The Signal

For every dormant rebel, there comes a moment when waiting becomes unbearable.

Somewhere between DeFi and the dollar, a new architecture hums.

Not an upgrade, nor a fork, but a return to logic.

Mezo is where Bitcoin learns to live.

Built by those who've been here since the early days. Those who remember when Bitcoin moved.

They recognized what Bitcoin always was: collateral for a world that doesn't exist yet. Or, more poetically, weight that wants to become motion.

So they shaped Mezo with that gravity in mind. With self-custody guiding first principles, sovereignty became embedded in the syntax.

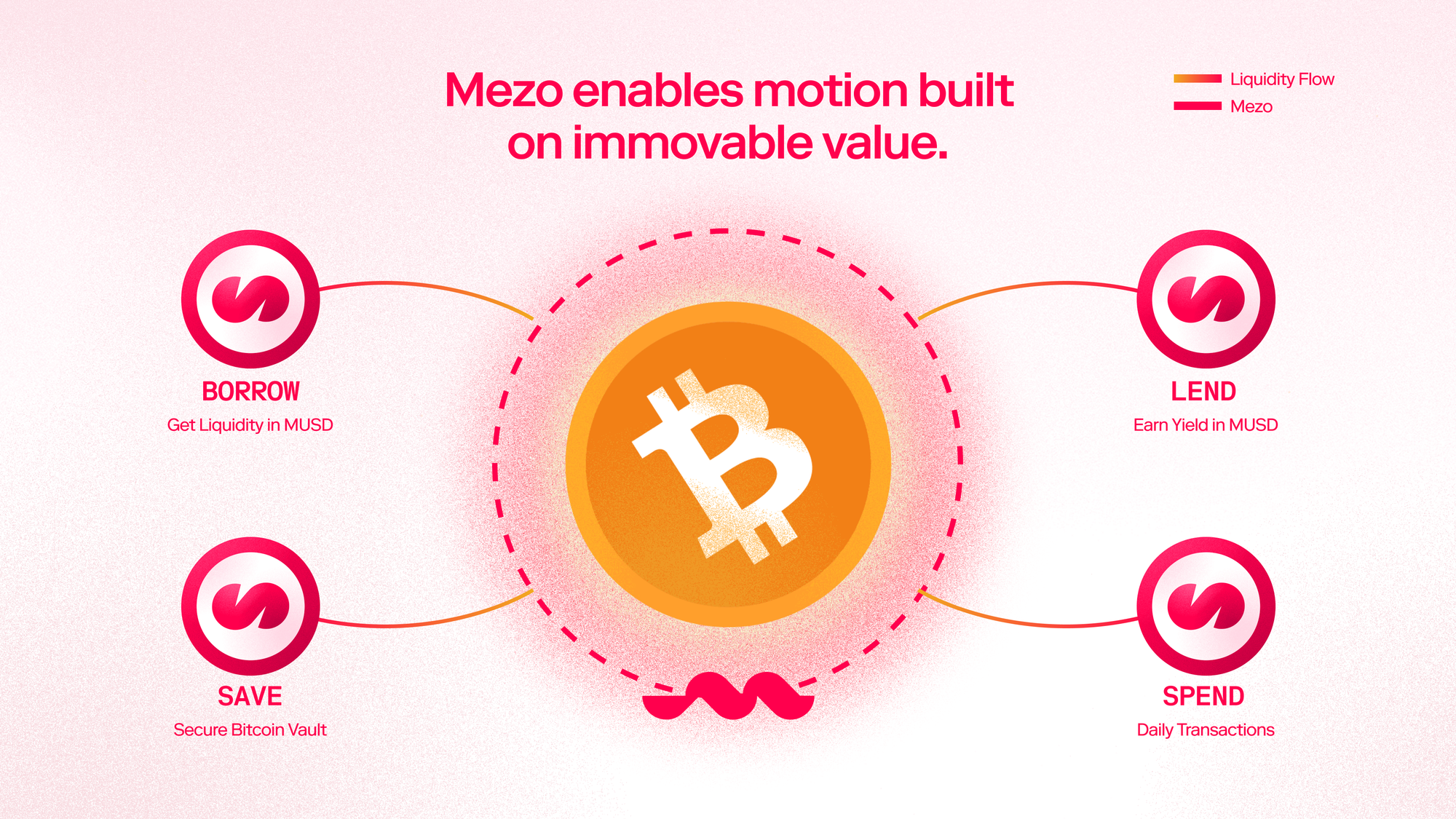

The result is a mirror currency that emerges from Bitcoin. Stable where Bitcoin is volatile. Spendable where Bitcoin is sacred. Redeemable for what cannot be seized.

On Mezo, your Bitcoin stays yours while gaining dollar-denominated liquidity that moves while the principal remains anchored. Weight and motion, reconciled.

If you understand why Bitcoin stopped moving, you already know what this must be. For the first time in history, the pattern that made holding rational and spending irrational has been dissolved.

The rebels’ fire doesn't need to choose between burning and surviving anymore.

Now, the waiting is over.

Chapter V: The Blueprint

The story of money is the story of control.

Monopoly makes money a weapon. Competition makes it a tool.

History proved this in 18th-century Scotland, where free banking created prosperity through discipline enforced by markets, not monarchs. Central banking deliberately buried those lessons.

Bitcoin revives the notion that money cannot be controlled. But revival alone isn't enough. The hardest money in history sits dormant because using it means losing it.

The solution was always going to include Bitcoin as the base monetary substrate, fiat currencies as the transactional layer, and a mechanism that lets you derive value from the first layer without selling for the second.

The goal is not to make Bitcoin easier to spend, but to make spending Bitcoin unnecessary.

Mezo is free banking for the digital age, upgraded to solve the challenges of the past.

For the first time, the rebel stands still without being trapped. Scottish free banking proved that competitive money works. Bitcoin proved digital scarcity works. Mezo proves they can work together.

The revolution is complete.

Conclusion: Bank on Yourself

Every rebellion begins with fire. Then come the long years of waiting — the quiet work, the compromises mistaken for peace.

The ember cools, but it never dies.

Bitcoin followed that same path. Born as peer-to-peer cash, it became collateral in vaults and balance sheets. The hardest money in history proved too valuable to spend. The fire survived, albeit locked away.

Mezo is the rebirth — a way to live from the same fire without burning it away. It lets savings breathe, liquidity flow, and freedom feel ordinary again.

On Mezo, Bitcoin stays in your custody and becomes collateral that powers daily life. Against it, you mint MUSD, creating immediate, dollar-denominated liquidity. Sovereignty and survival, together at last.

The architecture exists now to build what you once imagined. A world where the results of your work compound instead of evaporating. Where the hardest asset in history works alongside you. Where your children inherit positions that have been productive, growing, and building.

The revolution you dreamed of as a youth doesn't require burning it all down. It requires a better foundation. Mezo is that foundation.

The rebel never vanished. It was waiting for a reason to rise.

That reason is here.

Bank on yourself. Build what endures.