Understanding Bitcoin Interest Rates in Crypto Lending with Mezo

Learn how bitcoin interest rates are determined, the difference between CeFi and DeFi lending, and how Mezo offers secure, low fixed-rate Bitcoin-backed loans for everyday finance.

For over a decade, the wisest strategy in Bitcoin has been the simplest: HODL. But for all its success, this strategy has always presented a paradox. Your Bitcoin sits dormant. To use its capital to pay for a down payment, fund a business, or manage daily expenses, you faced a painful choice: sell your asset and sacrifice future gains, or entrust it to a centralized custodian, sacrificing the self-sovereignty that makes Bitcoin what it is.

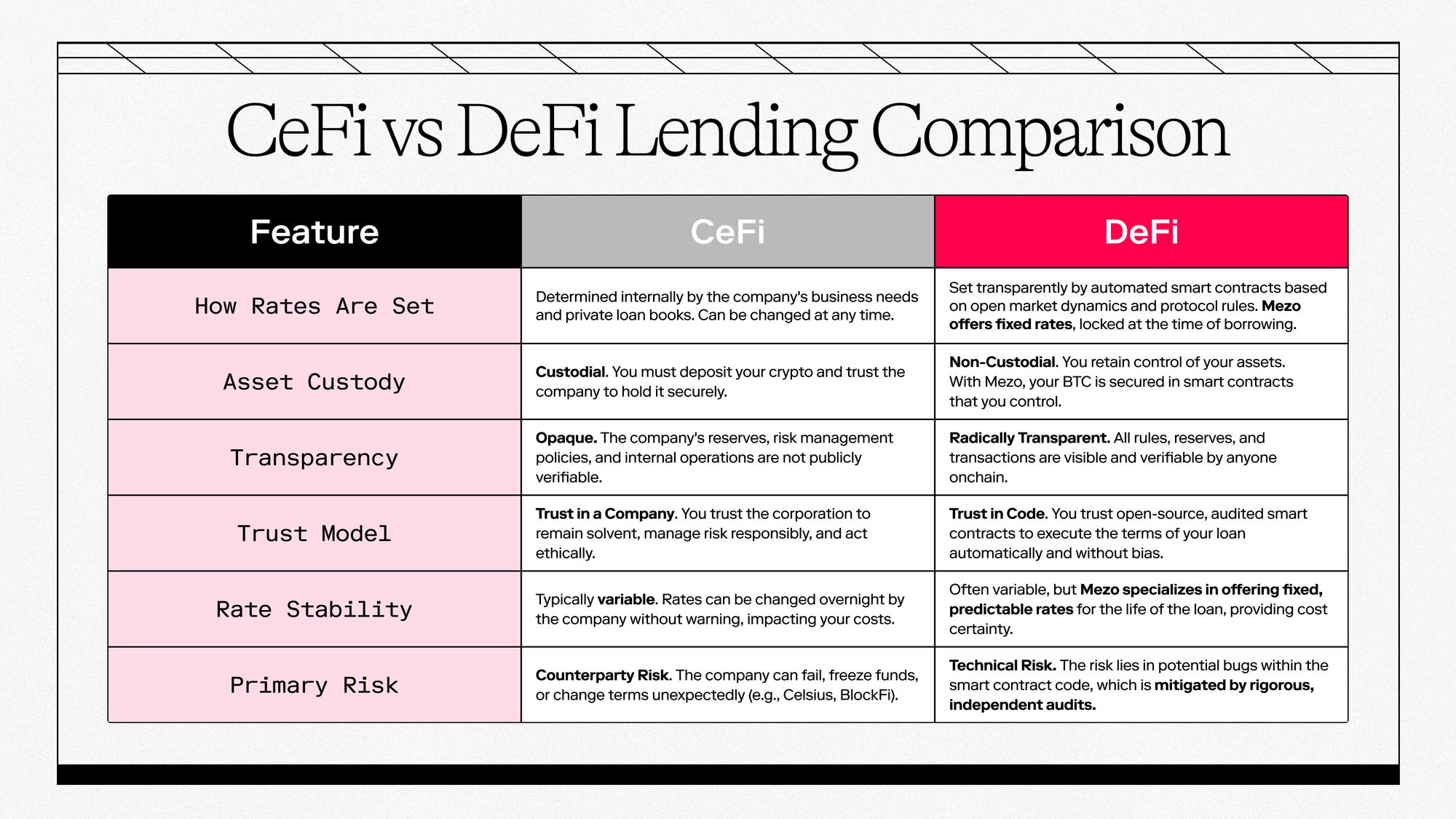

CeFi vs DeFi

The journey to solve this dilemma has been fraught with peril. The first wave of options came from centralized finance (CeFi) platforms like Celsius and BlockFi. They offered attractive yields, but at the hidden cost of counterparty risk. When the market turned, their opaque operations collapsed, proving that you never truly owned your assets in their world. The lesson was brutal and reinforced Bitcoin's core ethos: not your keys, not your coins.

Decentralized Finance (DeFi) eliminated the custodian with transparent smart contracts. Yet, for borrowers, a new risk appeared: volatility. Most DeFi crypto lending is based on variable interest rates that can spike unexpectedly, turning a manageable loan into a source of anxiety. It was transparency, without predictability.

This history reveals a clear path of evolution. Today’s holders demand a system that combines the transparency of DeFi with engineered stability. This is where Mezo provides an answer.

On Mezo, fixed interest rates are a core protocol mechanism. When you open a loan, the interest rate is a snapshot of the current global rate set by governance (1%-5%). Even if that global rate later increases, your loan’s rate remains locked. This creates a space of economic weather, allowing for true long-term planning. Should the global rate fall, a simple refinancing option lets you update your loan to the new, lower rate, ensuring you always have access to the most favorable terms.

But how do these interest rates actually work under the hood, and what are the key mechanics that set Mezo apart?

The Core Factors That Determine Mezo’s Low Interest Rates

The factors determining Bitcoin interest rates at Mezo include market dynamics, collateralization strategies, governance protocols, and liquidity conditions. Supply and demand play a foundational role: high borrowing demand pushes rates upward, whereas increased collateral supply tends to lower rates.

Collateralization practices also significantly impact interest rates. Mezo employs an overcollateralization model, ensuring borrowers deposit more Bitcoin than they borrow, effectively reducing risk and stabilizing borrowing costs. To take out a loan, your collateral must be worth at least 110% of your debt—the Minimum Collateralization Ratio (MCR).

For example, with BTC at $100k, a deposit of 0.03 BTC ($3,000) allows you to borrow up to ~2,727 MUSD. The fee structure is equally transparent: a small one-time origination fee and a refundable gas compensation deposit, which is returned when the loan is closed.

This system is built to withstand stress. While you keep the MUSD you borrowed, your collateral secures your loan. A liquidation can be triggered if a severe market drop causes your collateral's value to fall below the 110% MCR. This isn't a punitive measure but a transparent, automated process. External participants, called Callers, compete to repay the debt in exchange for the collateral and a small reward. This mechanism prevents bad debt from accumulating and protects the protocol's health.

A multi-layered system ensures the protocol’s solvency during liquidations. The primary backstop is the Stability Pool, a communal reserve capitalized by users who deposit their MUSD. This pool collectively absorbs the debt from liquidated positions, and in return for securing the protocol, these participants earn a proportional share of the forfeited collateral.

Crucially, Mezo bootstraps its own safety net via its Protocol Controlled Value (PCV). At its inception, the PCV smart contract initiates a 15 million MUSD loan to itself. This entire sum is immediately deposited into the Stability Pool, making the protocol its own largest liquidity provider from day one.

This is not a grant, but rather a self-repaying security mechanism. As the primary stakeholder in the Stability Pool, the PCV earns most of the collateral from user liquidations. These gains are then used to systematically pay down its original 15M MUSD debt over time.

The result is a massive, pre-funded cushion that ensures the system can handle liquidations robustly without relying solely on early user deposits. This protocol-funded backstop, combined with individual loan requirements (MCR) and a system-wide Recovery Mode (triggered if system collateralization falls below 150%), creates a multi-layered framework designed for long-term, sustainable growth.

Mezo is Your Home for Low-Interest Bitcoin Loans

Mezo's engineered framework—built on low-fixed and straightforward rates, transparent safeguards, and a pre-funded security model—finally solves the HODLer's dilemma. The era of passive holding has given way to active participation, and your Bitcoin is now ready to be put to work without compromise.

It's time to transform your assets. Borrow MUSD at a stable, fixed interest rate to unlock liquidity on your terms, or deposit into Mezo today to earn rewards while strengthening the very backbone of the protocol. Explore the Mezo platform today and discover how to turn your Bitcoin from a simple store of value into a productive engine for your financial life.

Learn more about Mezo’s pioneering stablecoin, MUSD, here.

Frequently Asked Questions (FAQs)

What is a bitcoin interest rate?

It's the percentage cost you pay to borrow funds against your BTC collateral, or the Annual Percentage Yield (APY) you can earn interest on by lending BTC. Mezo focuses on providing low, fixed borrowing rates for ultimate predictability.

Can I earn interest on bitcoin with Mezo?

Yes. Beyond borrowing, the Mezo ecosystem is designed with vaults and rewards structures that allow you to earn interest on your crypto assets, all while maintaining the security of self-custody.

How does Mezo set its bitcoin interest rates?

Our rates are determined by a combination of factors managed entirely on-chain: protocol governance, the level of overcollateralization, and overall market conditions. The process is fully transparent.

Are Mezo's rates fixed or variable?

Mezo specializes in fixed-rate loans. We believe borrowers deserve clarity and confidence, which is why we eliminate the uncertainty of variable rates.

What happens if the price of bitcoin drops?

Your loan’s health is measured by its loan-to-value (LTV) ratio, which is monitored constantly by smart contracts. If your LTV ratio crosses a certain liquidation threshold, a portion of your BTC collateral may be automatically sold to repay a portion of your loan, protecting both you from further debt and the protocol from risk. You can always add more collateral to avoid this.

Is my loan protected by smart contracts?

Absolutely. The entire lifecycle of your loan—from origination to repayment and collateral release—is managed by fully audited, open-source smart contracts.

How do I get my bitcoin back after borrowing?

Simply repay your MUSD loan balance. Once the loan is repaid, your BTC collateral is automatically and instantly released back to your control. No manual approvals, no waiting periods, and no hidden fees.

Let's build the circular Bitcoin economy.

Follow @MezoNetwork

🏦 Start borrowing • 📚 Read the docs • 💬 Join Discord • 🛡 View audits

Disclaimer: References to expected yields, APY, or other performance metrics are based on current performance and protocol parameters. Actual returns may be subject to change due to market conditions, protocol governance decisions, and other risk factors. Users are responsible for carrying out their own due diligence before choosing a Vault, and for monitoring any changes made to the Vault over time, particularly those subject to a time lock.