Why Credit Scores Don’t Matter in Bitcoin Lending

Borrow Bitcoin instantly with Mezo—no credit checks, no paperwork. Use your BTC as collateral, maintain custody, and unlock liquidity via MUSD stablecoins. Transparent, secure, and credit-score-free.

TL;DR:

- Credit checks don’t belong in BitcoinFi or DeFi. Your assets speak for themselves.

- With Mezo, you can borrow bitcoin without credit checks and keep full custody of your assets.

- MUSD enables stable liquidity while your BTC stays in place.

- There’s no paperwork, no red-tape. Your collateral is enough.

- Bitcoin-backed loans are changing how we think about credit, ownership, and financial autonomy.

Credit scores are a relic of the old world.

They are designed for a world where banks control access. With Bitcoin-backed lending, that logic doesn’t hold. Bitcoin-backed loans don’t ask who you are, where you’re from, or what your past looks like. They ask one thing: Do you have collateral?

Why Traditional Credit Checks Are Outdated

For decades, we’ve been conditioned to accept the credit score as the ultimate arbiter of financial access. It’s a surveillance tool disguised as a metric of reliability, one that prioritizes your past over your present assets. If you’re not visible to a bureau, you're excluded. Doesn’t matter if you have assets. Doesn’t matter if you’re solvent. If you’re outside the system, you don’t exist.

Bitcoin-backed lending shatters that prison.

Crypto lending, in general, has a tumultuous history. This is largely due to the fact that, although it was marketed as ‘crypto’, it was actually traditional finance in disguise. The spectacular implosions of firms like Celsius and BlockFi were not a failure of Bitcoin but a failure of transparency. These centralized entities operated like unregulated banks, taking user deposits and engaging in opaque, high-risk practices like rehypothecation (lending out user collateral to other institutions without user consent). They created a fragile, interconnected web of debt that was doomed to collapse, wiping out an estimated $4.2 billion in user funds from Celsius alone when the house of cards fell.

That is not DeFi. That is the same broken system we are trying to escape, just with a new coat of paint.

Bitcoin-backed lending, as it exists on-chain today, is architecturally different. This is why the truly decentralized portion of the lending market not only survived the 2022 contagion but has thrived, with DeFi's share of total crypto borrows growing from 34% to 63% by late 2024.

The difference is verifiable collateral. Unlike the under-collateralized, opaque loans that doomed CeFi, on-chain Bitcoin lending is built on three core principles designed to prevent the mistakes of the past:

- Verifiable over-collateralization: Every loan is backed by more collateral than its value, typically 150% or more. This buffer protects the system from volatility.

- User custody: Your BTC isn't handed over to a company to gamble with. It's locked in a transparent, publicly auditable smart contract that you control.

- Automated liquidation: If a loan becomes under-collateralized, the system doesn't rely on a CEO's discretion. An automated, on-chain process liquidates only the necessary collateral to maintain solvency. It's predictable, transparent, and removes human error and greed from the equation.

The takeaway: trustless, overcollateralized lending works. The problem wasn’t the tech. It was centralized intermediaries pretending they weren’t banks.

How Bitcoin Collateral Works in Practice

Using your Bitcoin as collateral is straightforward and powerful. Here’s how it works:

- You deposit your BTC into a secure smart contract vault on a lending platform like Mezo.

- The system calculates your maximum loan amount based on a loan-to-value (LTV) ratio. This ratio protects both the borrower and the lender from market volatility.

- You can then borrow against that collateral, receiving an instant loan as a stablecoin like MUSD.

The result: you unlock immediate liquidity without selling your underlying asset.

Is There a Catch? What You Need to Know About Liquidation Risk

Every collateralized loan involves market risk, whether in BitcoinFi, DeFi, or traditional finance. If the value of your collateral drops significantly, your LTV ratio will rise. The protocol may initiate a liquidation if it crosses a predetermined threshold (90%). This means selling a portion of your collateral to repay the loan and ensure the system remains solvent.

Responsible platforms empower you to manage this risk. On Mezo, you can monitor your position in real-time and add more collateral at any time to avoid a margin call or liquidation event. The power remains in your hands.

How to Repay Your Loan Without Hurting Your Credit

One of the most liberating aspects of a Bitcoin-backed loan on Mezo is that it operates entirely outside the traditional credit reporting system and does not inherit any of its limiting structure.

Borrowers have flexible repayment options and can repay their loan on their schedule without penalties for early payment. This is what we like to call Buy now, Pay never. Your loan is on your terms. If you maintain a healthy LTV, you can have a 1% fixed MUSD loan for as long as you see fit.

If you default, the only consequence is the liquidation of your collateral. Your credit score is completely unaffected. There are no collection agencies and no black marks on your record.

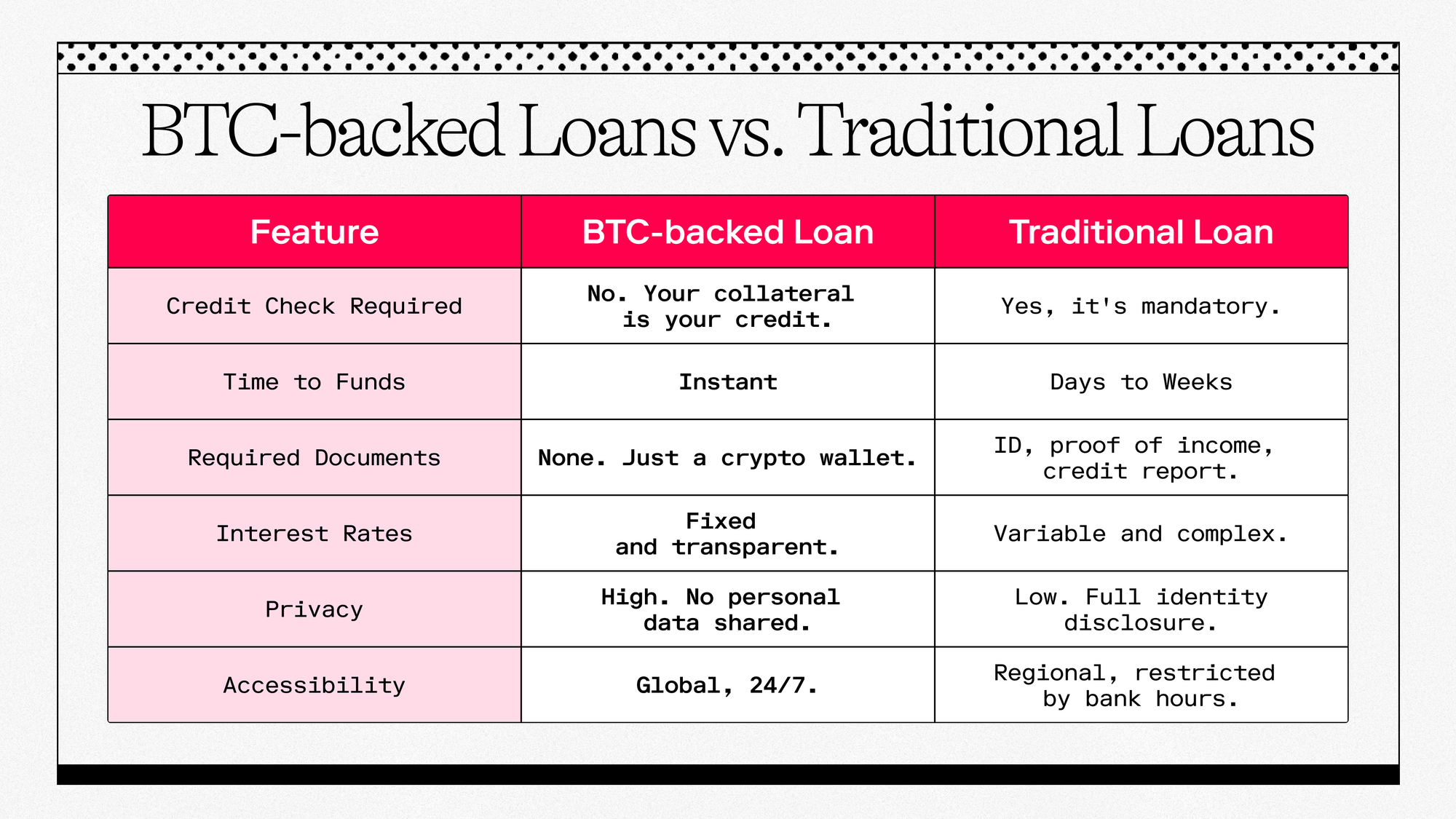

A Tale of Two Systems

The financial world has split in two: the old world of opaque credit scores and permissioned access, and a new, parallel system built on transparent, verifiable collateral. In this world, you don't need to prove your worth to a third party. Hold your BTC, and use its value too.

FAQ – Borrowing Without a Credit Score

Do I need a credit score to get a crypto loan?

No. The loan is based on collateral, not reputation.

What happens if I can't repay the loan?

Some or all of your collateral might be sold. Your credit score is unaffected.

Is crypto lending safe?

Depends on the platform. Mezo uses transparent smart contracts and shows you live risk metrics.

Can I get a loan without any collateral?

Technically possible, but rare. Most no-collateral loans involve higher rates, smaller size, and more risk.

What’s the best way to avoid liquidation?

Keep your LTV conservative. Add buffer collateral. Monitor your position.

🏦 Start borrowing • 📚 Read the docs • 💬 Join Discord • 🛡 View audits

Let's build the circular Bitcoin economy. Follow @MezoNetwork