Mezo Pools

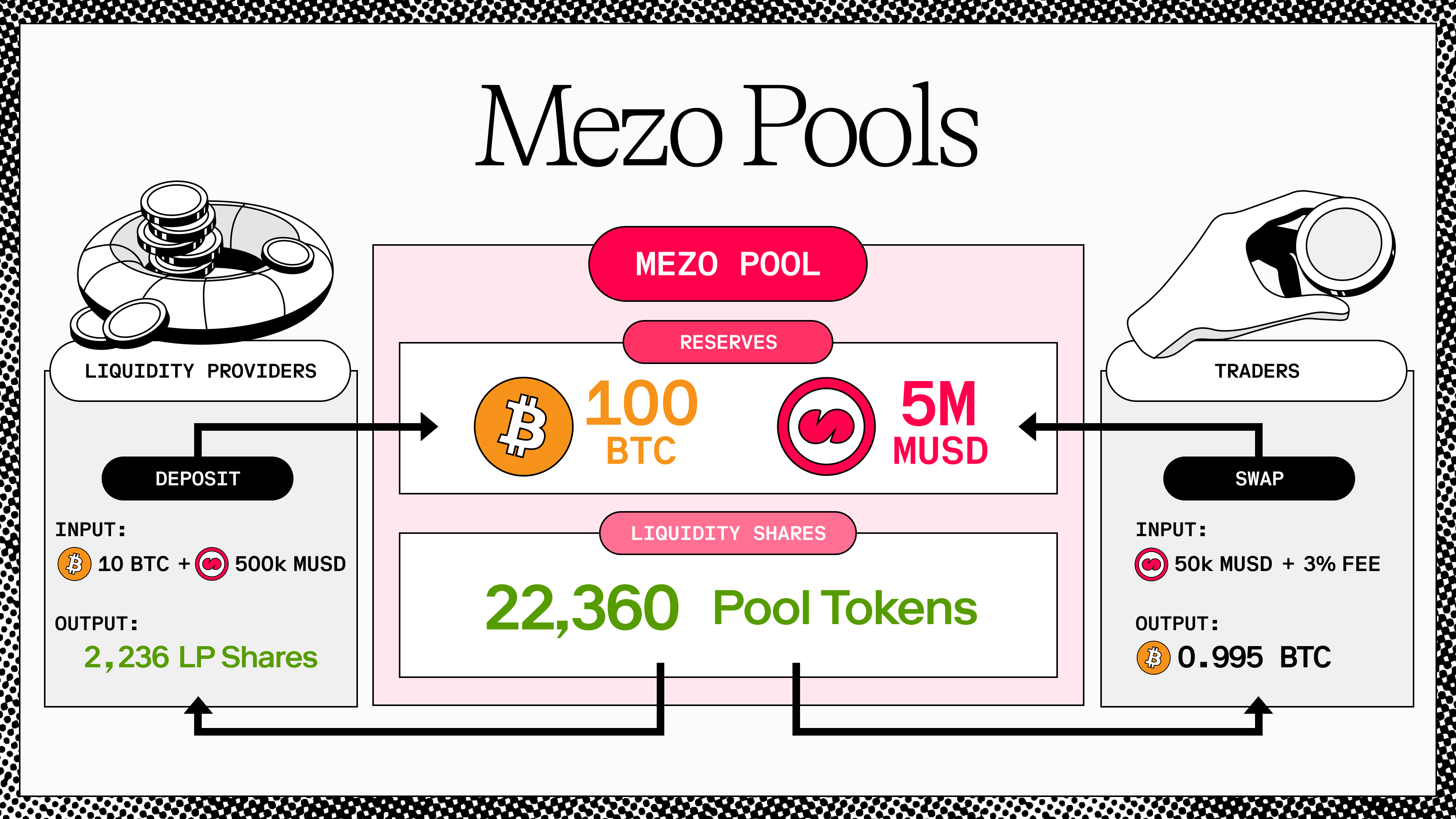

Mezo Pools are the core engine of the Mezo ecosystem, functioning as automated, on-chain liquidity reserves for Mezo Pools. Each pool holds a pair of two distinct tokens, enabling instant, decentralized trades. Instead of relying on a traditional order book to match buyers and sellers, users trade directly against the liquidity held within the pool.

Mezo Pools allow you to earn fees by providing liquidity for token swaps. When you deposit two tokens into a pool, traders can swap between them, and you earn a portion of the trading fees.

When a user deposits a proportional value of the required tokens into a pool, they become a Liquidity Provider (LP). This action is fundamental to the system’s operation as it deepens the available liquidity, reducing price slippage for traders. In return for their contribution, LPs receive LP tokens. These LP tokens are representations of an LP’s pro-rata share of the pool’s total assets. These tokens algorithmically entitle the holder to a portion of the trading fees generated by the pool and serve as the mechanism for redeeming their underlying deposited assets.

Mezo offers two distinct types of pools, optimized for different use cases:

- Volatile Pools: Designed for asset pairs with uncorrelated prices, like BTC and MUSD.

- Stable Pools: Engineered for assets with highly correlated values, like MUSD and USDC. These use a specialized formula to provide much lower slippage for trades between like-assets.

Understanding LP Tokens

When you deposit assets into a Mezo Pool, the contract mints and sends you LP (Liquidity Provider) tokens. These are standard ERC20 tokens that quantify your proportional ownership of the pool’s total reserves.

The number of LP tokens you receive is based on your share of the pool. For the very first deposit in a new pool, this amount is calculated as sqrt(x * y), where x and y are the quantities of the two tokens deposited.

For every swap executed through the pool, a trading fee (e.g., 0.30% in volatile pools) is charged on the input asset. This fee is instantly segregated into a separate contract, which is claimable by liquidity providers for that specific pool.

To reclaim your share of the underlying assets, you must “burn” your LP tokens; however, you can claim your fees anytime. When you claim your initially deposited assets, your LP tokens are returned to the smart contract in exchange for your pro-rata share of the two tokens in the pool.

The Mezo Pools Advantage

The Mezo protocol was designed without relying on traditional financial structures like order books. While order books are effective in centralized finance, they present significant challenges in a decentralized setting, often requiring active management by professional market makers and centralized infrastructure to host and match orders.

Mezo Pools are engineered specifically for a decentralized environment, leveraging the unique strengths of blockchain technology:

- Autonomous and Permissionless: Each pool is an open-access smart contract. Any user or application can permissionlessly interact with it by calling functions like swap() to trade or mint() to provide liquidity.

- Advanced Capabilities: Mezo Pool functions as an on-chain TWAP (Time-Weighted Average Price) oracle, providing manipulation-resistant price data for other protocols. They also support flash loans, enabling complex, single-transaction DeFi strategies.

These architectural advantages are the foundation of Mezo’s primary mission: to build a robust, circular economy for Bitcoin. By enabling users to take their BTC, use it as collateral (e.g., through Mezo Borrow to mint MUSD), and then deploy both assets into highly efficient liquidity pools, the protocol transforms Bitcoin from a passive store of value into an active, yield-generating instrument. This creates a self-sustaining loop where providing liquidity not only generates returns for the user but also deepens the market for Bitcoin-backed assets, making the entire ecosystem more liquid and useful.

Getting Started

How to Get Started in 3 Simple Steps

Ready to become a liquidity provider? It’s easy to get started. Visit the Mezo Pools to begin.

- Prepare Your Assets: To provide liquidity, you’ll need an equal value of both assets in a pair (e.g.,

$50 of BTCand$50 of MUSD).- Need MUSD? Mint it using your BTC on Mezo Borrow.

- Need other assets or MUSD? Use Mezo Pools to trade for them.

- Add Liquidity: Navigate to the Pools page on Mezo Explore. Select your desired pool, specify the amount you wish to deposit, and confirm the transaction. You will receive LP tokens in your wallet, representing your share of the pool.

- Stake & Earn (Coming Soon): Once staking is live, simply return to the Pools page, select your position, and stake your LP tokens to start earning more mats and more! Stay tuned.

Developer Resources

To integrate Mezo pools into your application, see Providing Liquidity in our developer documentation.